Topic

Beijing again looks to Wu Qing, who cracked down on malpractice at brokerages, to bring a firm hand and pave way for new investment measures.

- Developer stocks rose on Thursday after authorities in Hangzhou announced plans to buy some unsold homes

- Analysts and economists remain cautious about the scope of such aid, and whether it is the best way to rescue the market

Saudi Arabia’s Public Investment Fund and Michael Burry’s Scion Asset Management increased their holdings of Chinese large caps, while Singapore’s Temasek reduced its stock holdings.

Hong Kong stocks rally continues after China unveils more property support measures with gains supported by hopes the Federal Reserve will start cutting interest rates later this year.

Bridgewater Associates, the world’s biggest hedge fund slashed its holdings drastically in the first quarter in a move may have been too hasty and caused it to miss out on the recent bull run.

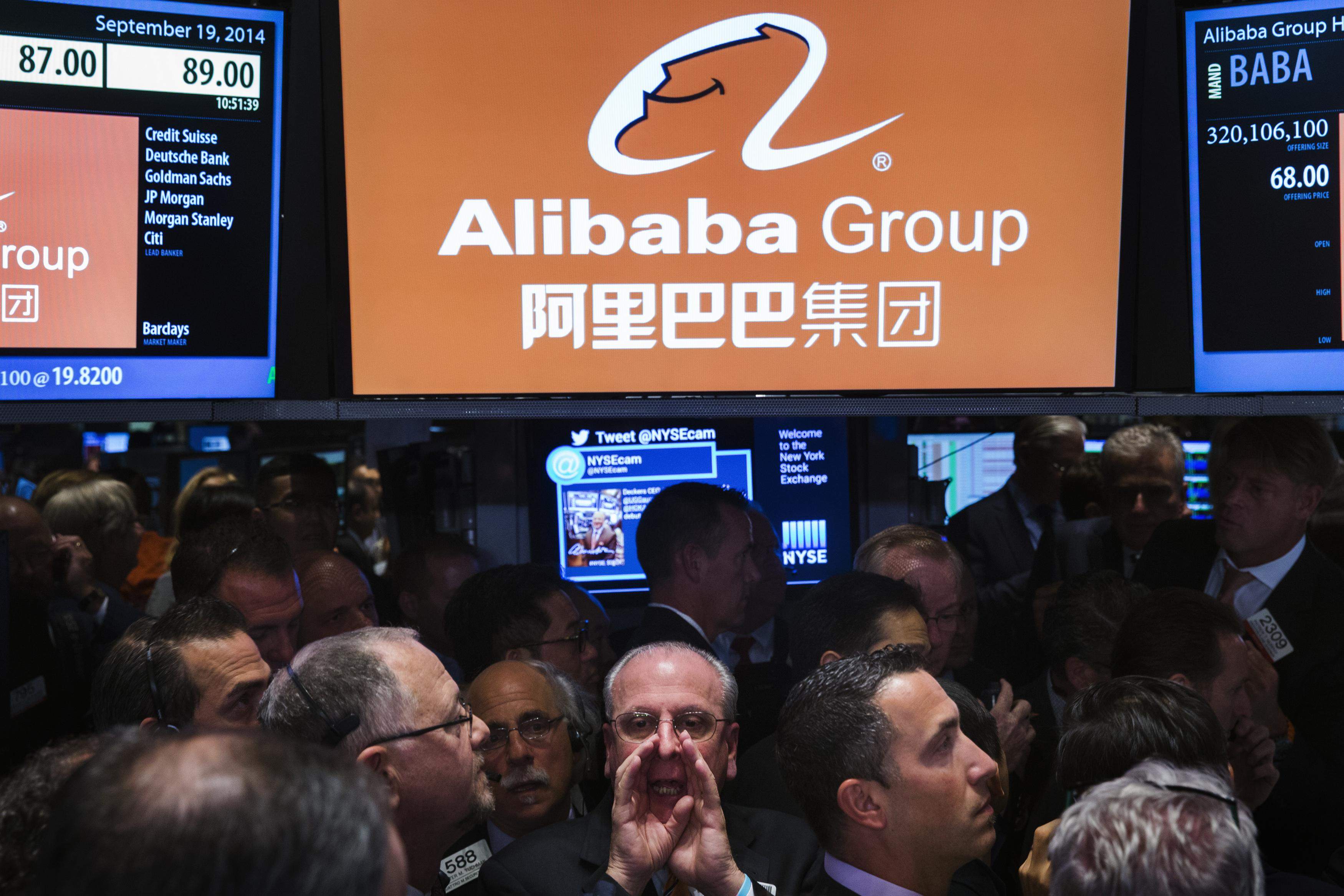

Alibaba Group Holding’s primary dual listing in Hong Kong could open the doors for China’s 210 million investors to buy a stake in the US$400 billion behemoth.

Mainland China stock markets are on the back foot after US-China trade tensions rose following increased tariffs on imports of Chinese semiconductors, electric vehicles, steel and batteries.

Enhanced mechanism set to boost international investors’ confidence in the onshore bond market and further internationalise the yuan, according to industry experts.

Stocks retreated from the highet level since August, taking a breather after surpassing the 19,000-point level. Gains in tech leaders such as Alibaba and Tencent tempered losses among developers and casino operators.

Enhancements aim to further open up China’s financial markets and strengthen Hong Kong’s status as an international financial centre.

Hong Kong is proving its resilience by defying some of its harshest critics. A surge in the local stock market over the past three months shows global investors are coming back.

The incentives will inject a dose of optimism and confidence in the capital markets, enhance cross-border trading schemes and boost the yuan, tax experts say.

Hong Kong stocks advance amid growing hopes of improved corporate earnings and policy support after tepid economic data over the weekend.

In an attempt to limit the impact of data showing foreign funds selling on market sentiment, Shanghai and Shenzhen exchanges plan to cease displaying real-time figures on purchases or sales of local stocks through trading links with Hong Kong.

Two regions can revitalise historical connections through financial collaboration, but more understanding is needed, says a director with index provider MSCI.

Insurer has sold about 5.6 million HSBC shares, reducing its stake in the lender to 7.98 per cent from 8.01 per cent, according to an exchange filing.

Economic optimism boosts Hong Kong stocks with growing hopes of US interest cuts providing an additional tailwind.

Harvest CEO Han Tongli said he ‘doesn’t rule out’ applying to get the spot crypto ETFs on the Stock Connect scheme as long as ‘everything goes smooth’ in the next two years.

Hong Kong stocks rise driven by economic optimism after policy loosening measures announced by nearly 60 Chinese cities targeted the floundering property market with upbeat trade data providing a further boost.

Investors should exercise caution while chasing Chinese stocks, among the best performers globally last month, amid technical signs the market is in overbought territory, US investment bank says in report.

‘Earnings are set to pick up as property activity stabilises and inflation recovery fuels household income and consumer spending growth,’ UBS strategist Meng Lei says.

Chinese regulators are scrutinising old business deals and bank accounts of senior executives as they ramp up inspections of stock-listing hopefuls. No companies have lodged IPO plans in Shanghai and Shenzhen this year.

Hong Kong stocks fell for the second straight day on Wednesday as investors awaited trade data which is expected to show both exports and imports returned to expansion territory in April, following a contraction in the previous month.

Swiss financial firm EFG has increased its investment in Chinese and other non-Japan Asian stocks, on expectations of steady growth in the region and driven by the belief the worst was over for stocks in China.

Hong Kong stocks decline from an eight-month high as traders cash in on the market bull run, while robust mainland tourism data for the holiday period fails to lift sentiment.

Investor sentiment has turned positive after a clutch of global investment banks made positive calls on Chinese stocks amid expectations of more policy support from Beijing.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

A dovish US Federal Reserve and a gigantic share buy-back programme from Apple lifted Hong Kong stocks with sentiment remaining upbeat after China’s top policymakers signalled further support to economic growth.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.