Topic

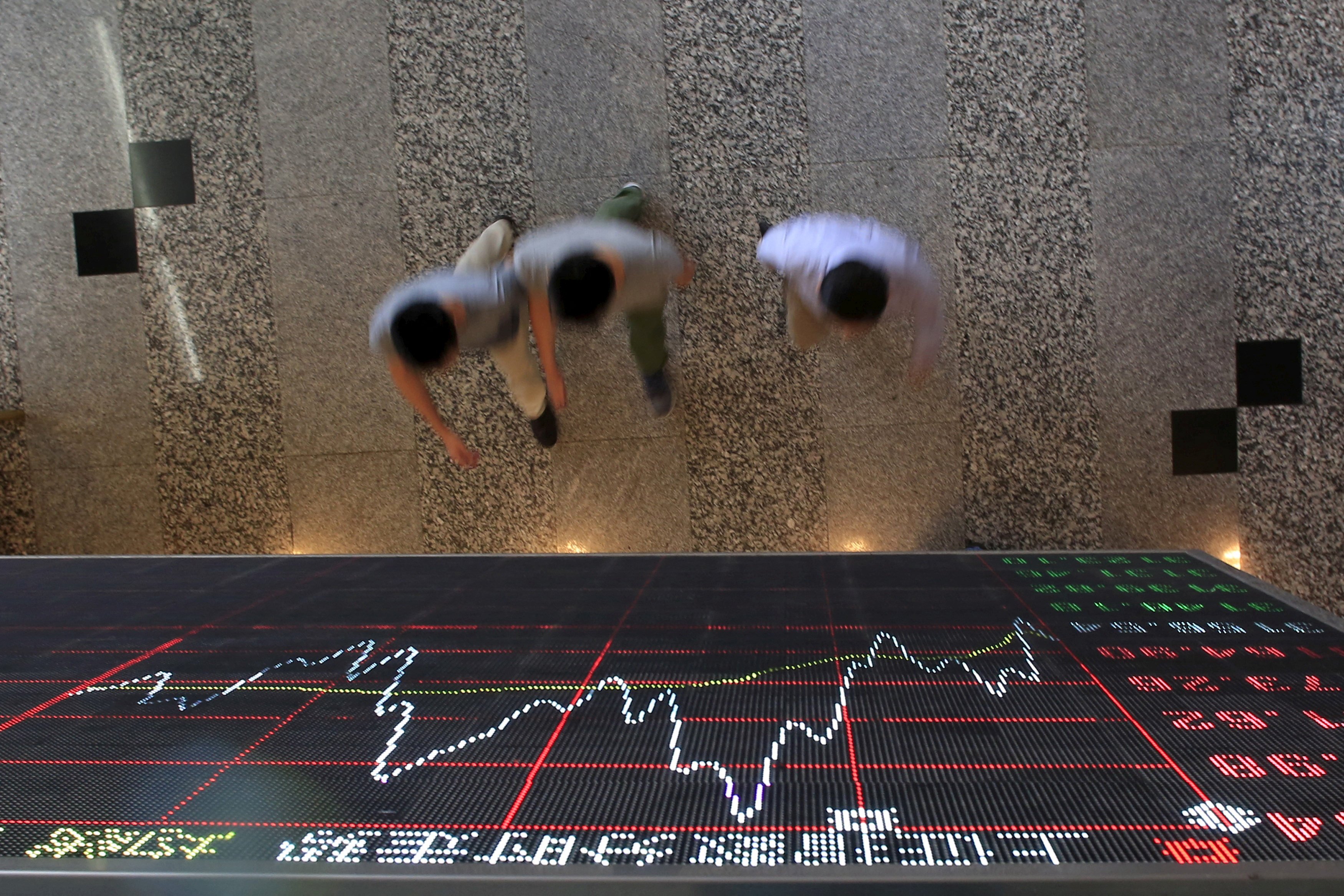

Latest news and features on investing, with a particular focus on the economies in Hong Kong, mainland China and Asia.

Large supply of homes due to come online soon in Hong Kong will, hopefully, help thwart the rise of a new generation of speculators.

Beijing has been slow to address the visa and e-payment woes of foreign travellers, and some officials remain complacent about the exodus of foreign investment. Amid Article 23 jitters in Hong Kong, Beijing must address the multitude of concerns.

- With China’s never-before-seen levels of economic upheaval, Koo warns ‘the consequences could be dire’ if a so-called balance-sheet recession takes hold

- Koo’s theories influenced Western policy after the global financial crisis, and now he has strong advice for Chinese policymakers and disillusioned young people

With consumption taking a hit in fraught economic times, safe-haven investments are outshining discretionary diamond purchases in the eyes of many Chinese buyers.

Bridgewater Associates, the world’s biggest hedge fund slashed its holdings drastically in the first quarter in a move may have been too hasty and caused it to miss out on the recent bull run.

The small-business financing platform co-founded by former HKEX chief Charles Li Xiaojia said it is asking staff to invest in the start-ups it backs, confirming an online article that sparked widespread discussion on social media.

Sham article is almost identical to one debunked two weeks ago, featuring Hong Kong movie star Donnie Yen and US talk show host Jimmy Kimmel.

Two regions can revitalise historical connections through financial collaboration, but more understanding is needed, says a director with index provider MSCI.

Valuable Capital, Hong Kong’s second-largest online broker, launched Sahm Capital in December, allowing users to trade in both Saudi and US markets.

Hong Kong Exchanges and Clearing, which runs the third-largest stock exchange in Asia, sees more listings from the Middle East and mainland China as market sentiment turns bullish, according to its CEO.

The new financial product underscores the flurry of collaborations and accords between Hong Kong and Riyadh since the February 2023 visit by Chief Executive John Lee Ka-chiu to the kingdom.

Data centre deals in the Asia-Pacific this year are expected to surpass the region’s record tally of US$3.45 billion in 2023.

Investors should exercise caution while chasing Chinese stocks, among the best performers globally last month, amid technical signs the market is in overbought territory, US investment bank says in report.

The number of private debt funds in the Asia-Pacific region grew by 22 per cent to 94 at the end of 2023 compared with a year before as financial institutions bet on the flourishing market.

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, continued its comeback in the first quarter, posting a return of HK$54.3 billion (US$7 billion) as rising overseas stock markets offset losses in domestic equities.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

Ever wondered how the Big Apple’s billionaires made their money? Here’s exactly how they did it – and what some have planned for it once they’re gone

Hong Kong will implement sound cybersecurity measures reinforced by strong backup systems to ensure a smooth launch of the MPF electronic platform next month, according to the MPFA’s Ayesha Lau.

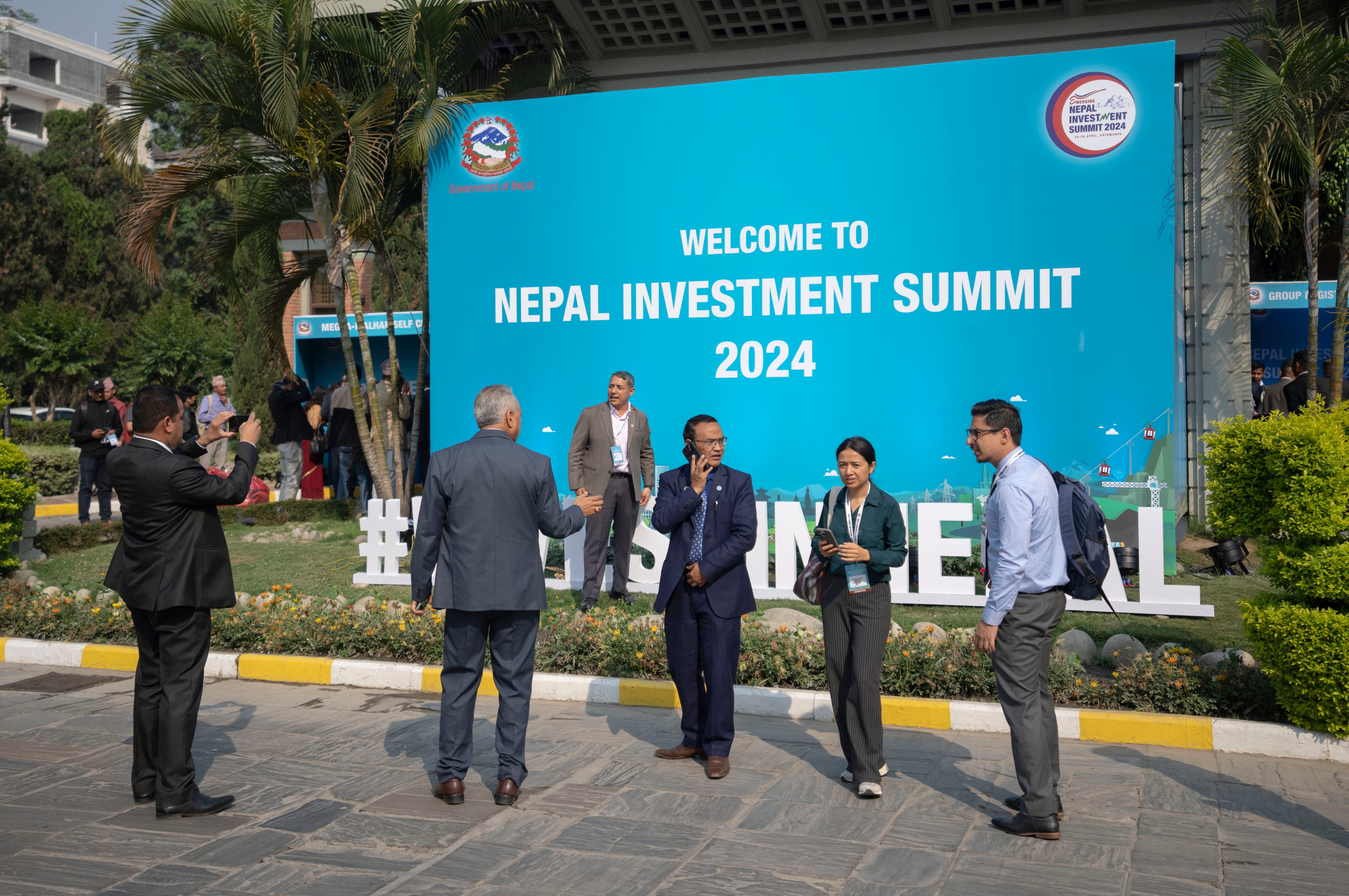

Nepal’s “dysfunctional” politics may curb its economic ambition amid jostling between India and China to step up their investments in the country.

Scammers have published a fictitious article with the appearance of a South China Morning Post story and a reporter’s byline to promote two online financial trading apps.

Total venture-capital investment in China in the first quarter fell 30 per cent quarter on quarter to US$11.5 billion amid economic uncertainty, geopolitical tensions, though China still accounted for eight of the top 10 deals.

Gold purchases in China rose by 5.9 per cent in the first quarter compared with the same period in 2023, as consumers seek security in ‘the only safe asset’, analysts said.

High inflation and elevated borrowing costs are dampening the attractiveness of leveraged private-market investments, but institutional investors across Asia-Pacific are still determined to increase their allocations in private assets, State Street says.

Disgraced property mogul Truong My Lan may have been the richest person in Vietnam at one point – before she was caught taking out billions in fraudulent bank loans

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

The Golden Horizon Fund, which will target companies across the Gulf Cooperation Council countries and China, marks the first time that CIC has invested in the Middle East.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.