Topic

A-share focus is for readers wanting to know more about mainland Chinese investment markets, and especially the A-share market in Shanghai, which has become accessible to international investors since the launch of the Shanghai-Hong Kong stock connect scheme in late 2014.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

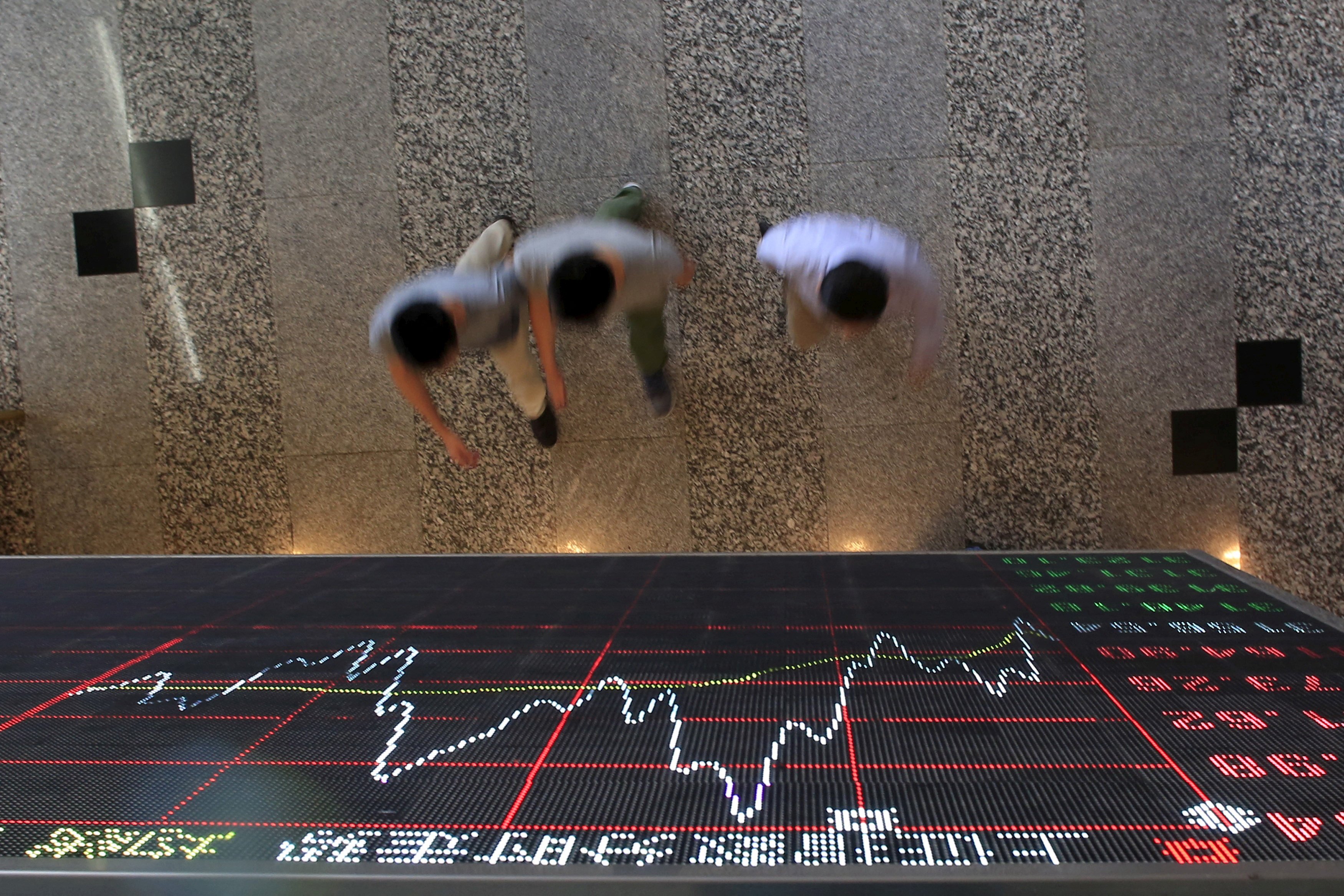

- Hong Kong stocks have been on a tear in recent sessions as China ramped up policy support for its battered property sector and amid speculation of a dividend tax relief

- Broader gains in Asia were spurred after core inflation data in the US inspired bets the Fed will deliver the cut in its policy interest rate in September and December

Alibaba Group Holding’s primary dual listing in Hong Kong could open the doors for China’s 210 million investors to buy a stake in the US$400 billion behemoth.

Mainland China stock markets are on the back foot after US-China trade tensions rose following increased tariffs on imports of Chinese semiconductors, electric vehicles, steel and batteries.

The incentives will inject a dose of optimism and confidence in the capital markets, enhance cross-border trading schemes and boost the yuan, tax experts say.

Hong Kong stocks advance amid growing hopes of improved corporate earnings and policy support after tepid economic data over the weekend.

In an attempt to limit the impact of data showing foreign funds selling on market sentiment, Shanghai and Shenzhen exchanges plan to cease displaying real-time figures on purchases or sales of local stocks through trading links with Hong Kong.

Economic optimism boosts Hong Kong stocks with growing hopes of US interest cuts providing an additional tailwind.

Hong Kong stocks rise driven by economic optimism after policy loosening measures announced by nearly 60 Chinese cities targeted the floundering property market with upbeat trade data providing a further boost.

Investors should exercise caution while chasing Chinese stocks, among the best performers globally last month, amid technical signs the market is in overbought territory, US investment bank says in report.

‘Earnings are set to pick up as property activity stabilises and inflation recovery fuels household income and consumer spending growth,’ UBS strategist Meng Lei says.

Swiss financial firm EFG has increased its investment in Chinese and other non-Japan Asian stocks, on expectations of steady growth in the region and driven by the belief the worst was over for stocks in China.

Investment banks including Goldman Sachs, UBS and BNP have become more positive on Chinese stocks, with foreign selling having subsided. But the property crisis, deflationary risks and tepid consumer demand mean global investors are yet to go all ‘all in’.

Foreign investors loaded up on Chinese stocks for a third straight month in April, adding to evidence that global fund managers have become more positive about the world’s second-largest market.

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

CICC cuts pay amid brutal business environment as a sluggish economy and dismal IPO volumes hurt the financial services sector.

Guolian Securities plans to buy a 95.48 per cent stake in unlisted Minsheng Securities, in an acquisition that is expected to make it a top-20 brokerage.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

Hong Kong stocks rose for a third day after earnings optimism drove the benchmark Hang Seng Index to a five-month high.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base

CSRC’s new chief Wu Qing has sought to improve corporate governance and close deep valuation discounts in a bid to revive investors’ faith in China’s US$9 trillion stock market and these bold moves have met with some early success.

Asia looks ready to turn a corner in quarterly earnings growth this results season. Here are five key themes to watch as the report cards roll in over the next few weeks.

Hang Seng Index hovers near a five-week low after comments by Fed chairman Jerome Powell, who said it could take ‘longer than expected’ to get inflation back on target.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.