Discounts are the order of the day for Hong Kong’s property developers to clear their stock, as prices trend downward

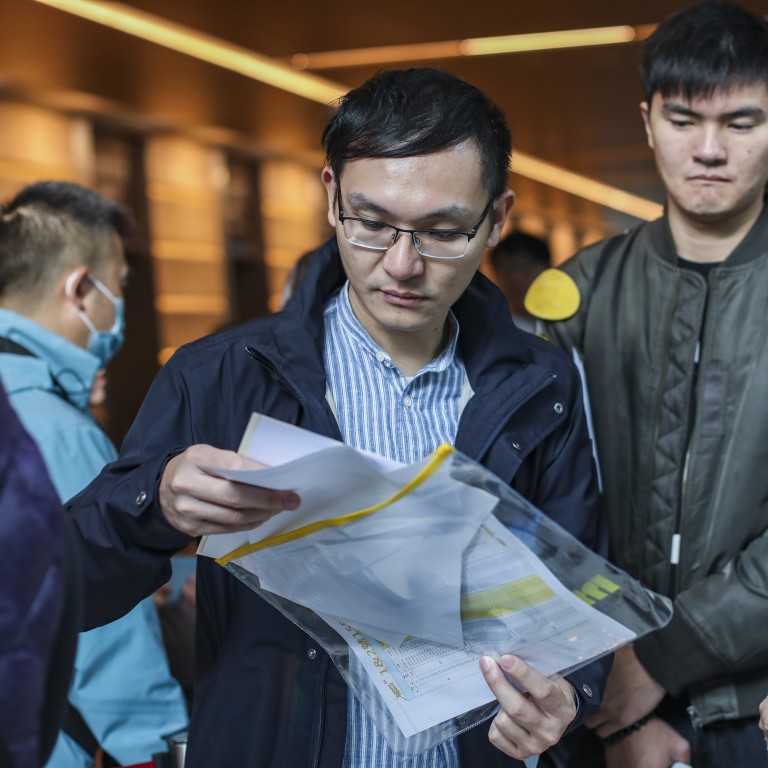

- Sun Hung Kai Properties sold every one of the 155 units on offer in the first batch of its Downtown 38 project in Ma Tau Kok

- Brisk sales were also reported in Tai Po at The Regent, where prices were cut by up to a third, compared with another project launched in July

Sun Hung Kai Properties, Hong Kong’s biggest home developer, sold all of its flats on offer at Ma Tau Kok over the weekend, after discounting prices by 50 per cent on average, compared with a similar project in the same neighbourhood.

The developer sold every one of the 155 flats in the first batch at the Downtown 38 apartment complex on Pai Tak Street in Ma Tau Kok, where prices for the units ranged from between HK$5.4 million and HK$7.9 million, or HK$17,621 to HK$19,193 per square foot. That is cheaper than the Oasis apartment complex in Kai Tak, about 1 kilometre away, which sold last October at a range of HK$28,816 to HK$41,503 per sq ft.

The weekend sale shows how Hong Kong developers have had to slash prices to clear their inventory, taking the cue from a government programme to lower the cost of living in the world’s most expensive urban centre. Declining prices are evidence that the housing bull market has ended, where a 28-month spiral in house prices ended in August.

A combination of government policies, higher mortgage rates and added supply of new flats pushed the city’s market to a tipping point.

According to data from the government’s Rating and Valuation Department, prices of Hong Kong’s lived-in homes have fallen 7.2 per cent in the past four months, and the city’s richest man Li Ka-shing, warned of further volatility on January 11.

There was “enthusiastic sentiment” over Downtown 38, which may continue as Hong Kong’s mortgage rates have remained stable, while concerns over the city’s slumping stock market had been given a breather by last week’s gains in the Hang Seng Index, said Centaline’s senior regional sales manager Daniel Chiu.

Brisk sales were also reported in Tai Po, where China Overseas Property sold 322 of the 486 flats at The Regent complex as of 6pm. Prices ranged from HK$11,105 to HK$14,555 per sq ft for flats that measure between 366 and 775 square feet.

“Demand for cheaper flats is strong and the purchasing power for the more expensive flats remains relatively weak, which means some may not be able to afford The Regent’s larger properties,” said Sammy Po Siu-ming, chief executive of Midland Realty’s residential division.

The developer sold 97 per cent of the first batch of 486 flats at The Regent last weekend. Two-thirds of the flats on offer were priced at HK$12,800 on average, with the remainder priced higher by between 1 per cent and 2 per cent.

All in, prices for The Regent were set 32 per cent lower than Sun Hung Kai’s St Martin apartments in the same neighbourhood, which were launched at HK$18,698 per sq ft in July.