Hong Kong government to sell only 2 plots of residential land in second quarter of financial year amid weak market sentiment

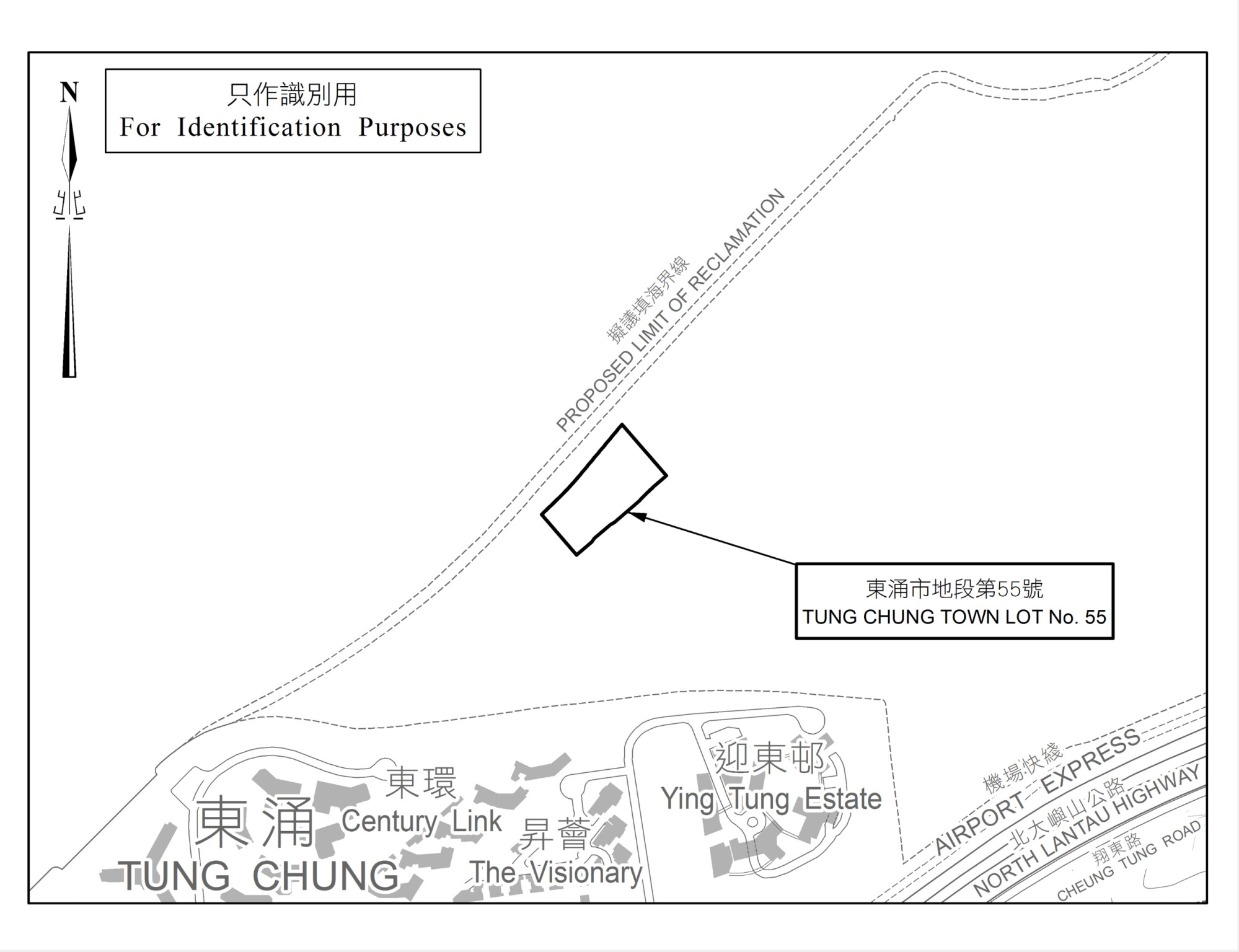

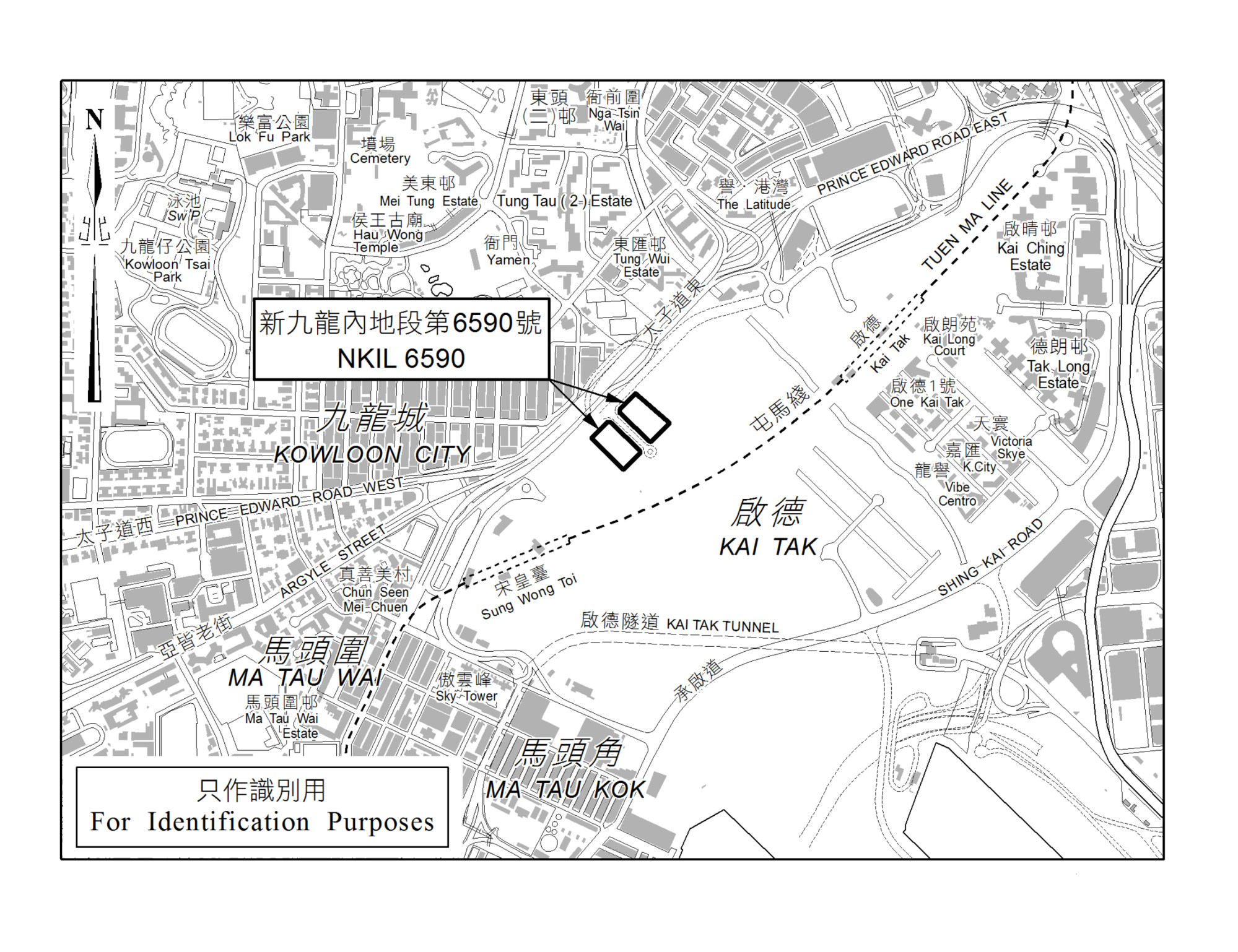

- The parcels in Kai Tak and Tung Chung, providing 1,739 flats in total, will be put up for tender between July and September, says Secretary for Development

- The total supply for the first half of the financial year – including private developments – should support some 8,280 flats, which is about 65 per cent of the annual target

The parcels in Kai Tak, the site of Hong Kong’s former international airport, and Tung Chung on Lantau Island, which will provide 1,739 flats in total, will be put up for tender between July and September, Secretary for Development Bernadette Linn Hon-ho said on Thursday.

However, the total supply for the first half of the financial year – including private developments – is expected to support some 8,280 flats, which is about 65 per cent of the government’s annual target for housing, Linn said.

Analysts suggested the surprisingly small offering of land in the second quarter may reflect the gloomy market conditions, though the government denied this was a factor in its decision.

A rapid succession of interest rate increases has cast a long shadow over a growing property oversupply that is being exacerbated by newly built flats coming onto the market.

“The current sentiment in the land market is not particularly good. In fact, there is a risk of having the tender withdrawn,” said Cyrus Fong, senior director, head of valuation and advisory at Knight Frank.

“Generally developers would be conservative in bidding for the tender due to the uncertainty in the economy as well as the interest rate hikes.”

Alex Leung, senior director at CHFT Advisory and Appraisal, had predicted four or five plots of land would go up for grabs in the second quarter of the financial year.

“The interest rate remains the main adverse factors,” he said. “Developers would not be willing to offer aggressive prices.”

For the Kai Tak parcel, valuations by five surveyors tracked by the Post ranged from HK$4,300 (US$549) to HK$6,500 per sq ft, or HK$4.4 billion to HK$7.08 billion.

For the Tung Chung parcel, valuations ranged from HK$2,840 to HK$3,300 per sq ft, orHK$1.14 billion to HK$1.2 billion.

Rising construction costs are likely to be another factor that would deter developers from investing in land at the moment, according to James Cheung, executive director at Centaline Surveyors.

Also, the reopening of Hong Kong’s international borders did not generate the expected surge of Chinese buyers back to the city’s property market, Cheung added.

“Developers’ bidding offers will be conservative,” said Dave Ma, chief executive of Hong Kong Property Services. “There has likely not been much profit generated by home sales from construction sites bought in recent years.

“I believe they want a good price when bidding for land now. You would not buy at the price of two or three years ago, nobody wants to do loss-making business.

“In the past, new projects would be sold in one go … but now possibly only half or one-third is sold after launch.”

The land sales plan comes after prices of lived-in homes in Hong Kong fell in May for the first time this year, as looming interest rate increases dampen demand.

Linn denied that land sale decisions are affected by market sentiment.

“For government land sales, we must primarily cater to our economic and housing land needs,” she said. “We cannot only sell land when the market is very good. We do not purely refer to market estimates.”

Hong Kong’s private home market will be flooded with new supply in the next couple of years, according to the latest forecast from the Our Hong Kong Foundation cited by Bloomberg Intelligence.

An annual average of about 20,200 private residential units will be completed this year and next, rising to 20,900 units in 2025, the think tank said.