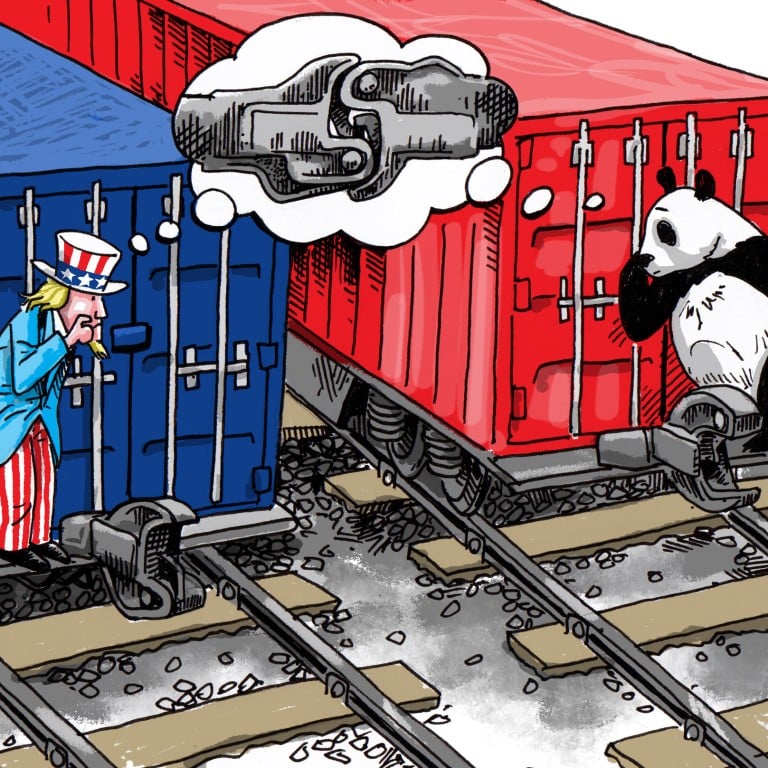

After all the talk of US-China decoupling, why ‘recoupling’ makes perfect sense now

- In some ways, this is moot as both economies continue to integrate in some markets and their policies start to converge around tighter regulation and antitrust actions

- But ‘recoupling’ can be useful if it means global pharmaceutical chains are left untouched, a minimum threshold is set for tech trade national security reviews, or the bilateral investment treaty is pursued

The amount of government bonds, trade and investment that one country has with another can be changed through policy intervention. But to what extent such change is sensible in terms of promoting national growth is debatable. After all, financial markets are fluid, trade diversion is natural, and non-financial investments are conditioned by matching production capacities.

The prevailing sentiment in China about actions by the United States and others on ties with China is mixed. There is a wish for ironclad ties, particularly in science and technology. But there is also a fear that, with imported technologies, China could end up hooked to a domineering or single source of supply.

As one industry analysis has it, one option for CIMC is to source components from North America and assemble the chassis in its production plants in California and Virginia, thus increasing American industrial capacity in this particular product.

So, after nearly six years of China-US decoupling talk, is “recoupling” a welcome change?

In a sense, we are already seeing a continuation of coupling at the market level between the two economies. Let me just mention three of them.

Make no mistake, the idea of “recoupling” is sensible.

With the global pharmaceutical production chains, both China and the US can leave well alone and show by example how technology can be used for the common good. No matter the acrimony over the political handling of the Covid-19 pandemic, both governments should create a favourable policy environment for their medicinal regulators and agencies to fully cooperate with each other, to assure the quality of traded ingredients and products.

Second, if the two governments can move towards convergence on the de minimis threshold in their respective national security reviews of the technology trade, it would help put “recoupling” into action.

In China-US diplomacy, the framing of policy intent in broad strokes, such as “recoupling”, is useful and can even be consequential. But it is specific policy actions that truly carry weight. Positive recoupling is still an attainable goal, even when it comes from reciprocal unilateralism.

Zha Daojiong is a professor in the School of International Studies and Institute of South-South Cooperation and Development at Peking University. This article is based on his presentation at a webinar organised by the Institute of International and Strategic Studies, Peking University, and the Center for Strategic and International Studies, in Washington DC, on October 21