Thanks to the Fed’s excesses of 2008, the world is bound for another economic disaster

- Instead of fixing the imbalances of the global economy, the Fed flooded the system with liquidity and kept interest rates low, sparking a speculative frenzy that has lasted to this day

- By buying government bonds to shore up pension funds, the Bank of England has shown the world how a looming crisis could play out

The world’s central banks are probably going to have to buy up bad assets to contain a looming financial crisis. This would slow down their fight against inflation, and result in higher inflation for longer. By extension, interest rates would go higher and stay there longer.

Thus, while a 2008-style financial crisis could be avoided, the higher interest rates would force asset markets to deflate anyway. To put it another way, the world would be swapping the financial explosion of 2008 for implosion.

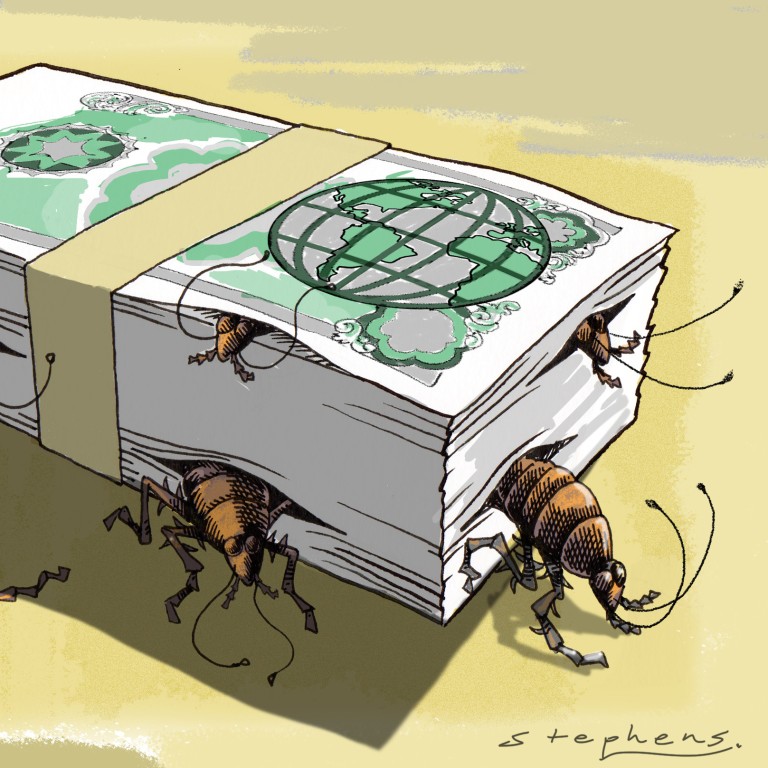

As the “cockroach theory” of markets goes, when you see one cockroach, many more are hiding. This seems to apply to high finance too.

The British pensions crisis is a warning about the fixed income industry. Super low interest rates in the wake of 2008 led to desperation among fixed income managers, who became susceptible to quack theories about low-risk yield pickups. There are probably a lot more fixed income funds around the world that have engaged in dodgy stuff.

Even crazier stuff awaits in the shadow banking system. After 2008, banking regulators around the world mandated stricter capital requirements, but risk appetite in financial markets grew in the low interest rate environment. Thus, the shadow banking system increased to warehouse risky assets and make the formal banking system look good.

As interest rates surge and stay high for years to come, a lot of the rubbish buried in the shadow banking system is bound to surface, threatening the world’s very stability. Central banks might have to swallow some of this rubbish, directly or indirectly.

The twin engines of inflation – the monetary overhang and labour shortages – are running strong. Consider the United States. Unit labour costs are rising at a double-digit rate as compensation rises and productivity declines. The Fed is unwinding pandemic quantitative easing, which will take three years at its current pace.

If one looks around the world, no major economy has interest rates meaningfully higher than inflation indicators – real interest rates are still negative. Those who expect inflation to go away under the current circumstances might as well be hallucinating.

Demographic trends point to a limited supply of labour in many major economies. The children who grew up during the internet age are entering the labour force, but this is a generation who are likely more interested in their phones than their jobs. A disruption of productivity is just beginning – and one consequence could be sticky inflation.

Are the stars aligning for India’s economy to shine?

The Fed kept printing money to juice the economy. The low interest rates sparked a speculative frenzy that has lasted to this day. It funded large fiscal deficits that subsidised consumption in the US and beyond. For a while, the policy appeared to work as economies resumed growth and asset markets went red hot.

So why was Bernanke wrong? What he failed to take into account was the need to reform a flawed economic system. The stimulus by itself merely pumped up the flawed economy and magnified the flaws over time. The hidden costs kept growing. But when the economy inevitably tumbles, all bills will be due.

The fundamental problem that the global economy faced before and after 2008 was the imbalance between the East and the West. In response to sluggish wage growth in the West (because of labour cost arbitrage by multinationals), major central banks kept the liquidity spigot open and in effect subsidised consumption with debt.

China, through the pegged exchange rate, matched the money printing in the US and this fuelled a massive bubble in Chinese property. China’s mandarins cleverly sucked the juice out of the property market to subsidise investment and production. Yet, this crazy balance between subsidised consumption in the West and subsidised production in the East was ignored by policymakers on both sides.

Excessive debt and asset bubbles have been accumulating on both sides. The cumulative problems are so vast that the consequences are beyond just financial or economic. As with the period of excessive speculation in the early 20th century, war and revolution might be waiting ahead.

Andy Xie is an independent economist