How the Federal Reserve helped create and burst the FTX crypto bubble

- As the Fed boosted liquidity, the odds of cooking up a successful scam improved greatly – and more people did

- Now that the Fed is winding down its bloated balance sheet, hot-air assets like cryptocurrencies are losing their life line

The Fed has actually kept the pace of balance-sheet unwinding rather slow (more on this later), given fears of a financial meltdown. But it is just prolonging the inflation crisis and keeping up the pressure for monetary tightening. Even if the Fed avoids the prospect of a thousand FTXes going bust together, the world will still see one collapse after another for the next couple of years.

As the Fed’s liquidity engulfed markets in recent years, the odds of cooking up a successful scam improved greatly and more people crossed over to the dark side. “Effective altruism” is something these people say to convince themselves that everything is OK.

Throughout history, questionable things have been done in the name of morality. One result is that Europeans have taken over much of the world, including North America and Australia, eliminating massive numbers of local peoples in the process.

As crypto assets mushroomed in value and created billionaires, Wall Street scrambled for a piece of the action. This was when the Fed’s liquidity really took over.

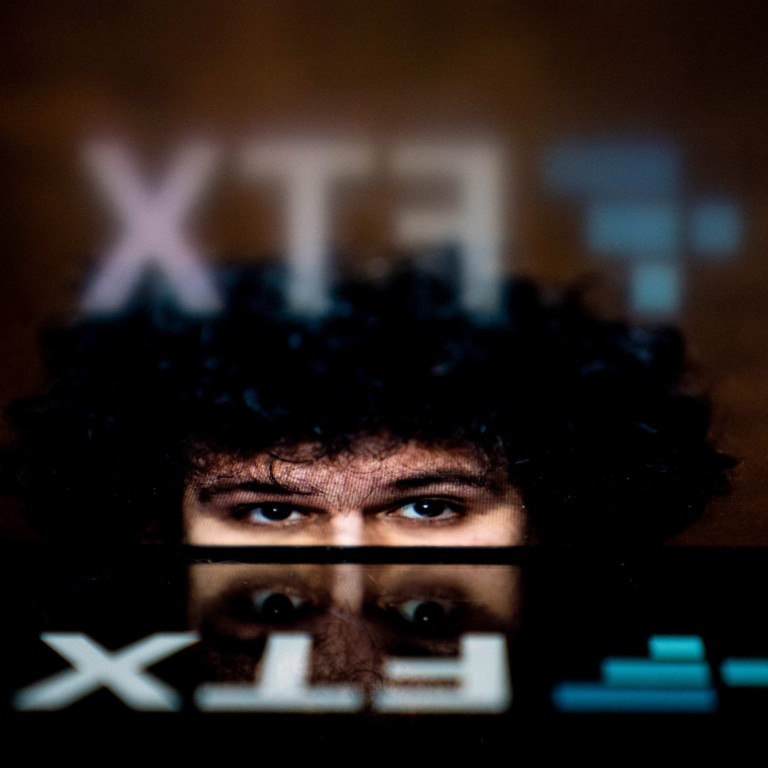

With the collapse of FTX, famous investors are likely to end up losing big. Lack of regulation has been blamed. The new boss of FTX, a restructuring expert who oversaw the bankruptcy of the energy giant Enron, said he had never seen anything worse than FTX.

Well, basically, anyone who had bothered to check FTX’s books would have known. But the investors who poured money into FTX never bothered. This raises another question: how has the financial sector grown so much in recent years?

Will young investors heed the Singapore central bank’s cryptocurrency warnings?

Since the global financial crisis of 2008, the world economy has been slow and unsteady. Obviously, opportunities haven’t been mushrooming. While there may be more opportunities in new technologies, total opportunities are ultimately driven by growth. Technology can only be a means of redistribution.

And yet the financial sector – private equity, venture capital and shadow banking – has grown rapidly. A new billionaire is minted every day or two. Much of the billionaires’ money has been made in the money game. Is this because they are smarter? The fact is that average IQ scores have declined over generations in rich countries. Financial guys can’t be getting smarter.

The real driver of the anomaly is quantitative easing, especially by the Fed. It makes crazy leverage possible. As the leverage magic swamped every tangible asset, some smart people invent hot-air assets, like cryptocurrencies and NFTs, for speculation.

After all, if something worth a dollar can jump 10 times in value, why not start from zero? While this would blur the line between overvaluation and fraud, from a financial perspective, the difference between the two is small. In this environment, entities like FTX could pop up anywhere, like bamboo shoots in spring.

You can bet the Fed has played sugar daddy to thousands of FTXes out there.

The current financial crisis is unfolding more like a Netflix series than a Hollywood blockbuster. Bombs aren’t going off together, unlike in 1997, 2000 or 2008. The reason is the slow pace at which the Fed is reining in liquidity. So far, the US central bank has trimmed its balance sheet by 3.7 per cent. The ongoing pace of quantitative tightening is US$95 billion a month, or about 1.2 per cent of the remaining balance sheet value. While the Fed has raised interest rates to 4 per cent, real interest rates are still negative against any inflation benchmark.

Fed’s excesses of 2008 put the world on course for another disaster

But the dream of cryptocurrencies replacing fiat money or being traded like oil and gold remains a pipe dream.

Andy Xie is an independent economist