China decides to rely on ‘larger scale’ tax cuts and home market to weather stormy 2019

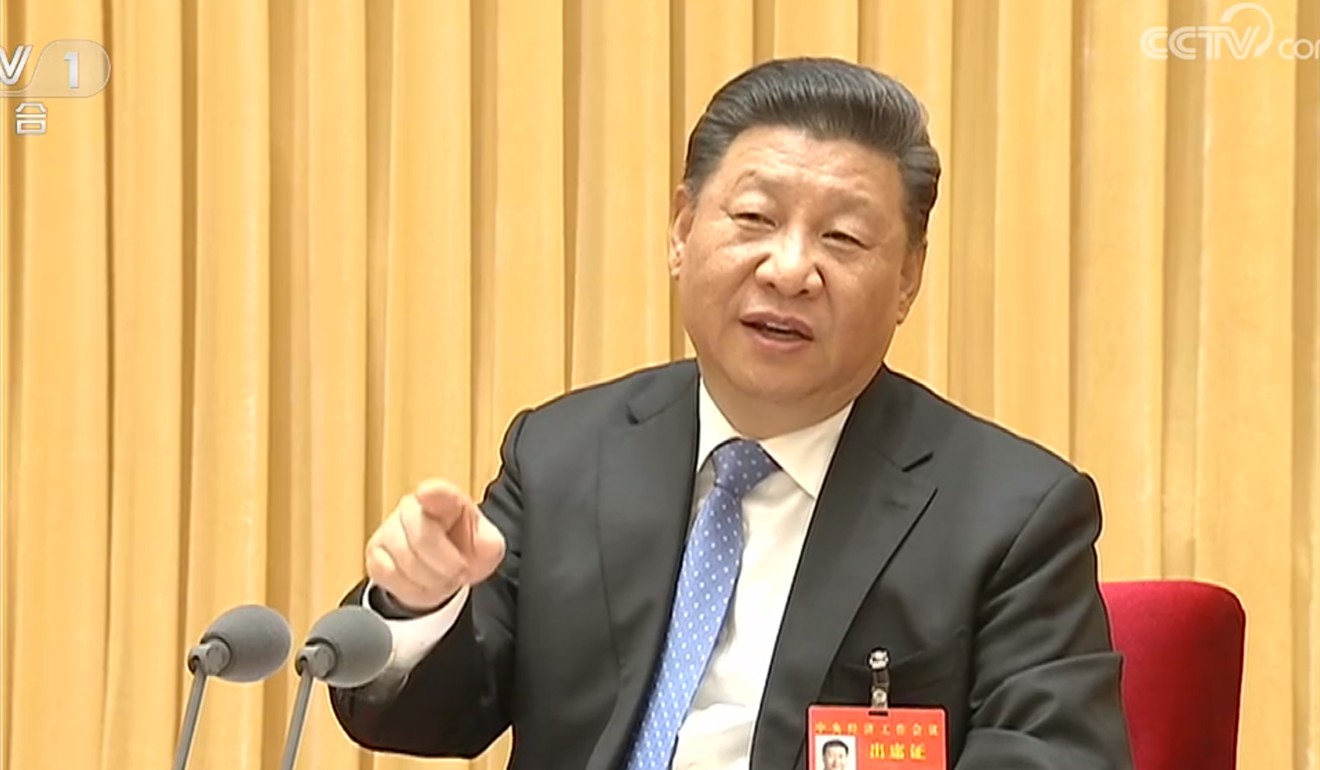

- Amid trade war with the United States, annual Central Economic Work Conference chaired by President Xi Jinping sets policy direction for next year

- Beijing says it will implement proactive fiscal and prudent monetary policy

China’s top leadership has decided to rely on deeper tax cuts and larger fiscal spending to manage economic headwinds in 2019, according to the official Xinhua News Agency on Friday.

The Xinhua summary contained the results of the key policy decisions from this week’s meeting of the Central Economic Work Conference (CEWC) in Beijing, a meeting of top Chinese officials chaired by President Xi Jinping.

The Chinese leadership concluded after a three-day closed door gathering that there are both “risks” and “opportunities” from recent changes in the external environment – a veiled reference to growing trade tensions with the United States – stressing that China’s good days are not over.

In response, China will “turn pressures into dynamism in promoting high-quality economic growth” by expanding domestic consumer spending, upgrading its vast manufacturing industry and increasing spending on infrastructure amid an increasingly hostile world.

“The world is facing a major change, the likes of which has not been seen in a century, and which includes both risks and opportunities [for China],” said the Chinese leadership.

“We must be good at turning risks into opportunities.”

The conference came at a critical time for the world’s second biggest economy, with western liberal democracies turning increasingly hostile to China’s state-subsidised domestic growth model and its private economy is dogged with the negative effects of the trade war with the US as well as general uncertainty about the economic outlook.

Xi, who could remain China’s president beyond 2023 after a constitutional amendment in March abolished term limits, faces the significant challenge of keeping economic growth on track next year amid the trade war.

Chinese growth slowed to a decade-low rate of 6.5 per cent in the third quarter and is set to slow down further next year under pressure from US tariffs.

Xi must also respond to the tight schedule to reach a trade deal with the US during the current 90-day truce period that expires March 1.

At their policy meeting earlier this week, the Chinese leadership agreed that China “steadily and properly handled China-US trade frictions” in 2018 while stressing that they will put into practice the agreements reached by Xi and US President Donald Trump in Buenos Aires on December 1 and to push forward with negotiations to resolve the trade impasse.

Ding Shuang, chief Greater China economist at Standard Chartered Bank, noted that the statement from this year’s CEWC was “much longer” than those in previous years, showing the Chinese leadership’s intention to improve its communications and disclose more details of its policy intentions for next year to shore up market confidence.

“The length and all-embracing proposals showed that China is now facing a lot of challenges,” Ding said.

“People in China were confused about the direction of reform and development and there were doubts over China’s strategy abroad. It seems Beijing is using the conference to give clearer messages.”

At same time, Ding issued a note of caution that the implementation of the policies outlined by the CEWC will be crucial, since Beijing has already made many promises to reform the economy and help struggling private businesses.

The conference, which was attended by virtually all China’s senior leaders, agreed that China must eventually rely on its home market alone for future prosperity.

As part of this process, the conference reiterated an older goal that China must “urbanise” 100 million citizens by 2020.

“China’s consumer market is one of the biggest in the world and there’s huge potential to develop it,” said the Chinese leadership.

To boost consumer confidence and household spending, China will increase the supply of services in education, childcare, health care, entertainment and culture.

The Chinese leadership concluded that the country needs significant amounts of additional investment to upgrade the manufacturing sector, to roll out new 5G telecommunication networks, to development artificial intelligence as well as improving infrastructure in rural areas.

While China’s leaders said they will protect the intellectual property rights of foreign businesses in China and allow overseas investors to have full ownership of their ventures in a wide range of sectors, China will stick to its goal of “making the state capital more powerful, better and bigger”.

Specifically, China will convert its state-owned railway company into a joint-stock structure in 2019.

The Chinese leadership did not mention the controversial “Made in China 2025” plan in the statement, but they made it clear that they will encourage technology progress and innovation.

“China’s development has enough resilience and huge potential, and the long-term trend of robust economic development has not changed,” they said.

The Chinese government will enhance “countercyclical” adjustments in 2019, implementing a proactive fiscal and a prudent monetary policy with the overall aim of keeping economic growth within a reasonable range.

Specific policy steps will include cutting taxes and fees “on a larger scale” than this year and significantly boosting the limit on the amount of special purpose bonds that local governments can issue, the proceeds of which are reserved for infrastructure and utility investments.

Iris Pang, Greater China economist from ING Wholesale Banking, said Beijing made it clear that much of the expected government fiscal stimulus would be channelled through the expansion of special purpose bonds by local governments and more direct financing – essentially banks loans – to support private enterprises.

This means official fiscal deficit will not significantly increase, since local government special purpose bonds are excluded, but there will be more debt build-up in the future.

“This will be another wave of increases in local government to support debt for the future. It will be a big concern since these special purpose bonds will mature in 2-3 years,” Pang said.

“Increasing direct funding also creates another debt issue because it in fact pushes banks to subsidise private firms. I had not expected the stimulus on loans to private firms to be so direct and clear.”

At the same time, Beijing will continue to pursue Xi’s top three areas of concern, namely debt cutting, pollution reduction and poverty alleviation.

“China has achieved initial victory in the three battles this year and we will pick up the key fights in next year,” it said.