Beijing warns China’s US$63 trillion financial sector: serve the real economy and enrich lives

- To stabilise the economy and shore up innovation, China’s leadership is taking a more heavy-handed approach to financial governance

- Analyst says People’s Daily commentary mainly points to risks in China’s huge shadow banking industry that has filled the gaps left by the traditional banking sector

China’s financial sector needs to focus on supporting the real economy and must refrain from “fake financial innovation”, state media has proclaimed amid a tightening of regulations as Beijing seeks to flex its financial might.

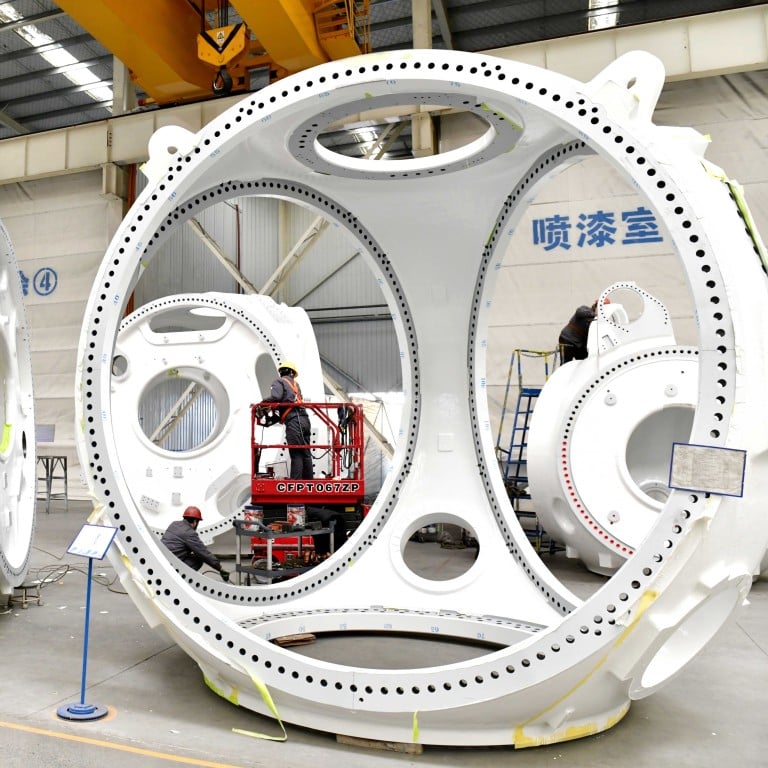

In what is widely believed to be a warning against capital idling and speculative activities by banks and lending institutions, People’s Daily called for the 453-trillion-yuan (US$63 trillion) financial sector to be more dedicated to technological innovation, advanced manufacturing, green development and small enterprises.

Financial institutions should avoid “letting money circulate within the sector” for the sake of arbitrage, and should not allow themselves to be distracted from the real economy, the Communist Party mouthpiece said in a commentary on Friday.

China’s plan to grow economy with infrastructure is self-contradictory: analyst

“Now some companies are taking advantage of the low interest rate for bank loans, borrowing from traditional banks and lending the money at higher rates, and thereby leading funds to circulate in the financial sector without entering the real economy,” he said.

Beijing has vowed to regulate all financial activities. But at the same time, it has pledged to further open up to the global market to achieve its goal of turning China into a financial powerhouse.

China’s stock exchanges on Tuesday banned a major quant fund from trading for three days, citing “market disruption”, to stabilise the market and prop up investor confidence.

The CSI 300 Index, which tracks the biggest stocks listed in Shanghai and Shenzhen, suffered a cumulative 41 per cent slide from early 2021 through 2023. It has climbed 1.62 per cent so far this year.

“Innovation is the driving force of the financial industry, but innovation must be based on integrity,” the state commentary said, calling for financial resources to “better serve the wider economy and make people’s lives easier”.

Li Yang, chairman of the National Institution for Finance and Development, said high-level meetings on China’s financial system in recent months indicated that China’s leadership is putting more emphasis on function over profitability.

China says no more to cash-strapped localities who levy fines for funds

“The first thing is to fulfil its functions, which is to serve the real economy, and to support scientific and technological innovation, the Belt and Road Initiative, and industrial policies,” he said in a speech during a seminar co-organised by the Shanghai Development Research Foundation last month.

China is facing an “extremely challenging strategic task” to become a financial superpower with its own characteristics, as President Xi Jinping ordered, he noted.

It still lags far behind the United States in many aspects, with issues including an unbalanced structure of financial institutions, a high-risk debt market, and a sluggish stock market, he said.