China’s Premier Li assembles economic experts ahead of hotly anticipated first-quarter data release

- Li Qiang’s chat with business leaders and trusted economists puts onus on what can be done at home while external environment becomes ‘increasingly complex, severe’

- Analysts are becoming more upbeat on China’s economic growth outlook, with expectations rising, but also calls for more fiscal stimulus

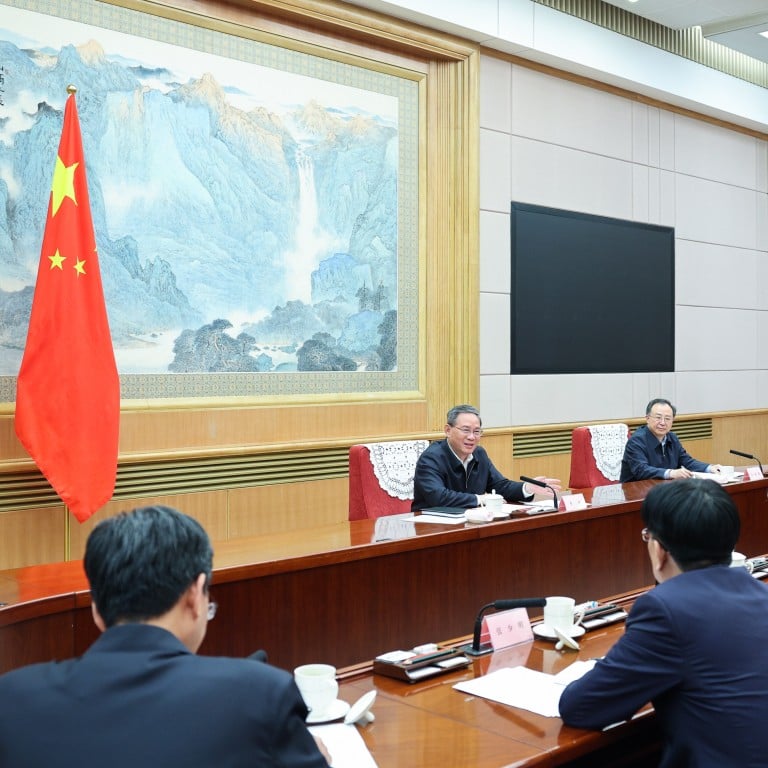

While getting the lay of the land from economists and entrepreneurs on Monday, Premier Li Qiang painted a big bullseye on sustainable economic growth while acknowledging what has been a persistent lack of demand and pledging to remove on-the-ground barriers.

In discussions concerning the current state of the world’s second-largest economy – about a week before the anticipated release of first-quarter data – China’s No 2 official discussed what still needs to be done against the backdrop of domestic hurdles and mounting external uncertainties.

China needs to “focus on scientific and technological innovation to promote industrial innovation and the outstanding issue of insufficient effective demand” as it looks to build internal growth momentum, an official readout quoted the premier as saying in the Monday meeting.

The first-quarter economic data, scheduled to be released by the National Bureau of Statistics next Tuesday, is poised to provide fresh insight into the country’s economic recovery and help gauge how leadership intends to keep China’s gross domestic product (GDP) growth at “around 5 per cent” this year.

China’s Li Qiang dismisses ‘overcapacity’ concerns in talks with Janet Yellen

Contending that Beijing’s macro policy mix is working, Premier Li said: “The current external environment is increasingly complex, severe and uncertain, and we still need to work hard to fix problems that exist in the economy.”

Solutions should include improving the consistency of policies and better implementing them in practice, he said. The message comes as authorities have been scrambling to shore up business confidence and inject life into economic-boosting activities.

Those invited to share their insights, including four key economists and four business leaders, said “positive factors in economic development are increasing, and market confidence has improved”, while conceding that stiff headwinds are still an issue.

Meanwhile, the premier took the opportunity to reiterate that China’s economy has “a solid foundation and many advantages”, and that the long-term upward trend of China’s development will not abate.

Some investment banks and international organisations have already raised China’s economic growth forecasts for the year following upbeat figures for January and February.

Owing mainly to better policy delivery and positive figures concerning consumption and investment, Citi has lifted its growth forecast from 4.6 per cent to 5 per cent. Nomura has also raised its projection from 4 per cent to 4.2 per cent.

And on Monday, the Asean+3 Macroeconomic Research Office, a Singapore-based macroeconomic surveillance organisation, estimated that China’s economic growth will reach 5.3 per cent for 2024, saying that its growth momentum should pick up moderately, and that authorities have “ample policy space and capacity to navigate through these challenges”.

Speculating on the upcoming March and first-quarter data, Wang Tao, an economist at UBS Group, was expecting better quarter-on-quarter momentum but slower year-on-year GDP growth.

“Partly due to a high base [from 2023], we expect a year-on-year decline in property sales, slower retail sales and [industrial production] growth, largely stable [fixed-asset investment] growth, and we expect exports will slide into a small year-on-year contraction,” she said in a research note.

But there are still multiple challenges facing the economy, as many economists have flagged, including a prolonged property market slump, huge levels of local-government debt, and weak exports.

“The country is still in the downward stage of the financial cycle. Insufficient demand is the main issue,” China International Capital Corporation said in a note late last month. “More fiscal stimulus is needed to consolidate the foundation of economic recovery.”