Malaysia files criminal charges against Goldman Sachs in 1MDB probe

- Goldman Sachs has been under scrutiny for its role in helping raise funds through bond offerings for 1MDB, which is the subject of investigations in at least six countries

Malaysia filed criminal charges on Monday against Goldman Sachs and two of its former employees over the alleged theft of billions of dollars, heaping fresh pressure on the Wall Street titan over the 1MDB scandal.

Goldman subsidiaries and former bankers Tim Leissner and Ng Chong Hwa are accused of misappropriating US$2.7 billion, bribing officials and giving false statements when helping to arrange bonds for state fund 1MDB.

Allegations that huge sums were looted from 1MDB in an audacious fraud that involved former Malaysian leader Najib Razak and his cronies, and used to buy everything from yachts to artwork, contributed to the last government’s shock defeat at historic elections in May.

Both former Goldman employees had already been charged over the scandal in the US last month, with Leissner pleading guilty while Ng was arrested in Malaysia. Low Taek Jho, a Malaysian financier accused of masterminding the fraud, was also hit with new charges.

The news represented a fresh blow to Goldman, where corporate culture has come under scrutiny after a steady stream of accusations surrounding its involvement in the controversy.

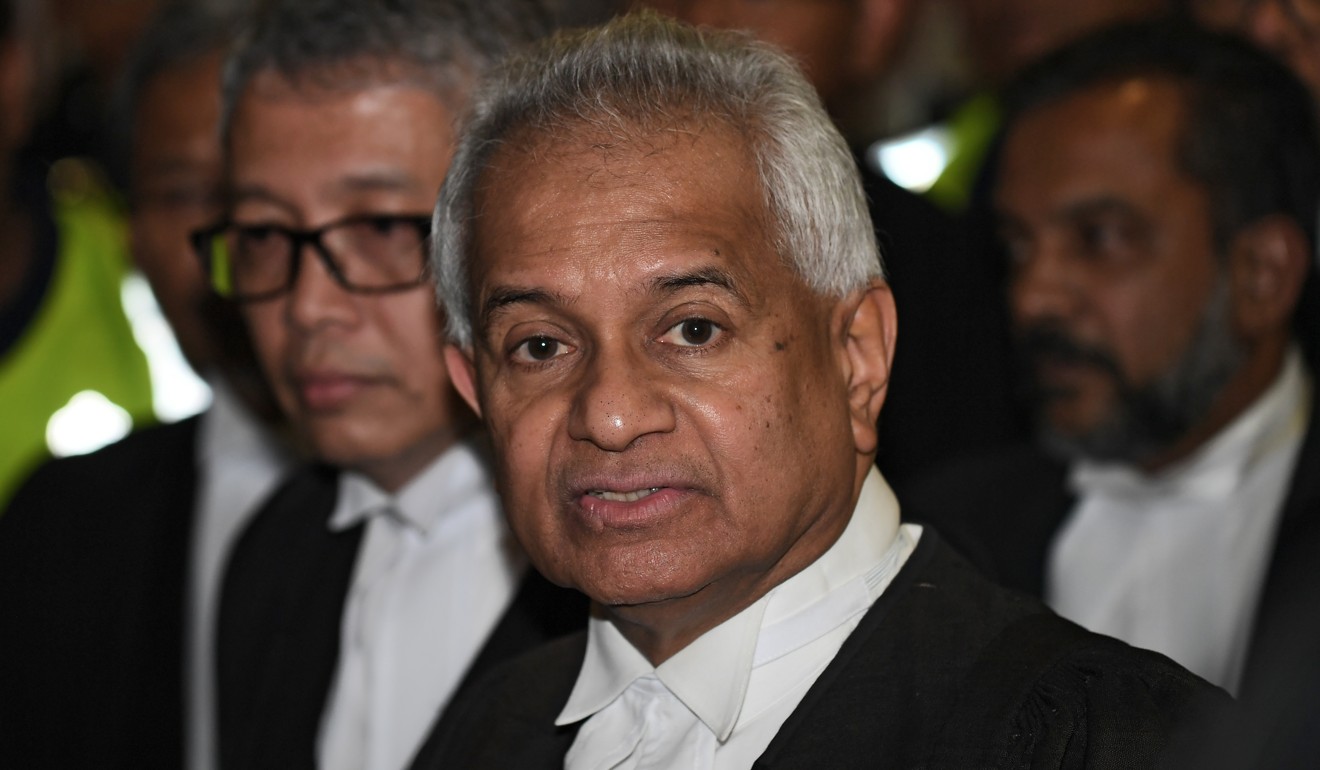

“Having held themselves out as the pre-eminent global adviser/arranger for bonds, the highest standards are expected of Goldman Sachs,” said Malaysian attorney general Tommy Thomas, as he announced the charges. “They have fallen far short of any standard. In consequence, they have to be held accountable.”

Goldman will “vigorously defend” against the charges, spokesman Edward Naylor said in an email.

Goldman has come under fire for its role in underwriting bonds totalling US$6.5 billion on three occasions for 1MDB, for which they earned an eye-watering US$600 million in fees.

Thomas said the bank and its former employees were accused of making false and misleading statements to misappropriate US$2.7 billion from the bond issuances, which took place in 2012 and 2013.

Malaysia’s Anwar Ibrahim takes a hard line against Goldman Sachs for being ‘complicit’ in 1MDB corruption scandal

Leissner, who worked as Southeast Asia chairman and managing director at Goldman, and Ng, a managing director at the bank, conspired with Low and others to bribe Malaysian officials to ensure Goldman was selected to work on the bonds, Thomas said in a statement.

The money earned by Goldman for the bond issuances was “several times higher than the prevailing market rates and industry norms”, the statement said.

Those accused personally benefited from receiving stolen funds and also got large bonuses and improved their career prospects, and false statements were presented to investors suggesting the proceeds of the issuances would be used for legitimate purposes, Thomas said.

Najib says he’s ‘lucky’ to avoid sodomy rap as Malaysia opens fresh probes into 1MDB

Prosecutors would seek fines well in excess of the US$2.7 billion allegedly misappropriated from the bond issuances and the US$600 million fees as well as long prison terms for the individuals accused, Thomas said.

The charges brought on Monday were under Malaysian security laws, for which the maximum jail term is 10 years. As well as Leissner, Ng and Low, Malaysian authorities also charged former 1MDB employee Jasmine Loo Ai Swan.

Malaysia’s new Prime Minister Mahathir Mohamad, who came to power in part on a pledge to investigate the 1MDB scandal, has been taking an increasingly tough line against Goldman and has accused the bank of having “cheated” the country.

A steady stream of negative news concerning the scandal has come out of the US, focusing on the great lengths the bank went to in courting 1MDB.

It emerged last month that former Goldman chief Lloyd Blankfein met Low – commonly known as Jho Low – at a reception in 2009 hosted by Najib at a hotel in New York while the former premier was visiting the US.

Since his election defeat, Najib has been arrested and hit with dozens of charges over the scandal and is probably facing a long jail term.

.png?itok=arIb17P0)