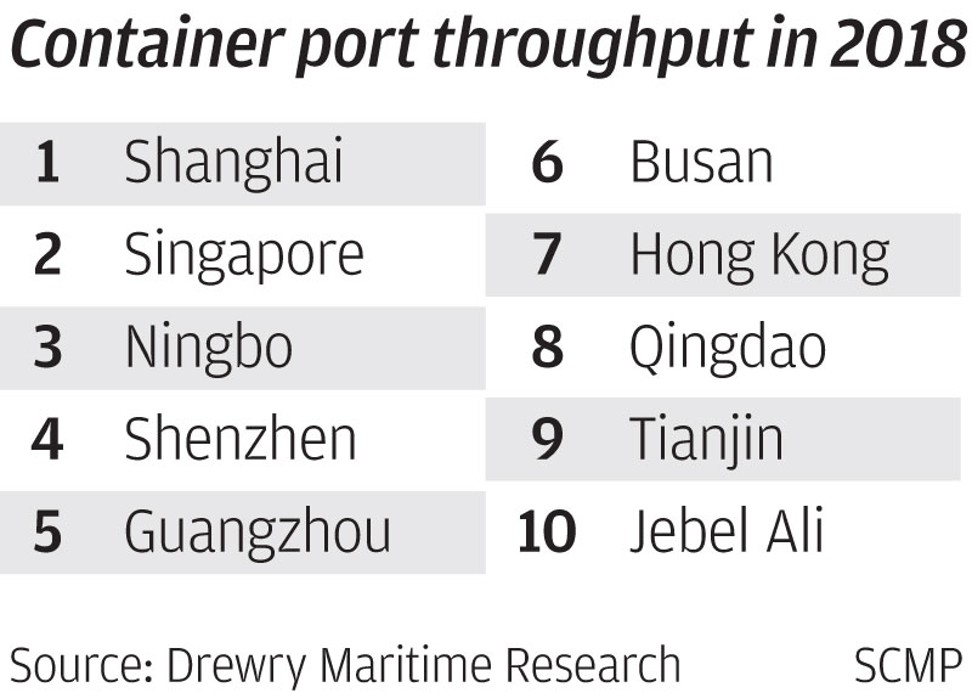

Hong Kong’s port business drops out of top five in world for first time as Asian rivals Shanghai, Singapore, Ningbo, Shenzhen, Guangzhou and Busan leave city in their wake

- City was dominant global player as the world’s busiest port for more than a decade until 2004, but sank to No 7 last year

- From its glory days in the 1990s, Hong Kong has seen its competitiveness eroded and its transshipments to mainland China diminished

The city was a dominant global player as the world’s busiest port for more than a decade until 2004, but sank to No 7 last year from No 5 after Shanghai, Singapore, Ningbo, Shenzhen, Guangzhou and South Korea’s Busan in terms of throughput, according to London-based Drewry Shipping Consultants.

From its glory days in the 1990s to losing its crown to Singapore in 2004, which was in turn dethroned by Shanghai in 2010, Hong Kong has seen its competitiveness eroded and its transshipments to mainland China diminished.

The initial impact of the trade war is also aggravating Hong Kong’s woes, with more uncertainties and risks ahead.

Hong Kong trade chief reckons with local cost of US-China tariff war

“For many years, through to the 1990s, Hong Kong was really the only effective port for serving southern China, as mainland Chinese ports were underdeveloped,” Drewry senior analyst Neil Davidson said.

“Since then, of course, mainland Chinese ports like Shenzhen and Guangzhou have seen huge expansion and investment in modern facilities, and have become much more effective competitors to Hong Kong.”

For many years, through to the 1990s, Hong Kong was really the only effective port for serving southern China

Last year, Hong Kong handled 5.4 per cent fewer shipping containers, at 19.64 million 20-foot equivalent units (TEUs) – the industry measurement based on a standard 20-foot container – which was less than half the 42.01 million units handled by Shanghai.

Among the world’s top seven ports, Hong Kong was the only one with declining throughput last year.

“I feel bad about it,” Hong Kong Container Tractor Owner Association chairman Lam Hoi-tat said.

“You can tell how the industry has shrunk throughout the years in terms of the number of container trucks in the city.”

He noted there were only around 10,000 container trucks left in Hong Kong, compared with some 30,000 in the 1990s.

Lam described the added impact of the trade war as “the straw that broke the camel’s back”.

The mainland, Singapore and even Busan enjoyed strong policy support from their governments, he said, while Hong Kong’s shipping industry relied on investments by the private sector or container port operators themselves.

Drewry’s Davidson said direct shipment between mainland China and overseas ports had effectively squeezed Hong Kong out of the game, as infrastructure became more developed across the border and factories were located closer to ports there.

The recent performance of Hong Kong’s biggest port operator, tycoon Li Ka-shing’s Hutchison Port Holdings Trust, underlined how the industry fared.

Li Ka-shing’s empire, Wharf hold outsize role at Hong Kong’s port

The company and its associates, through Hongkong International Terminals (HIT), COSCO-HIT Terminals, and Asia Container Terminals, together operate nearly 70 per cent of 23 berths at the Kwai Tsing port in the New Territories. Their throughput last year was 6.6 per cent below that of 2017.

Hutchison Port, which also runs ports in Yantian, Shenzhen and Huizhou, suffered an asset impairment loss of HK$12.28 billion last year arising from global trade uncertainties and migration of factories from the mainland to overseas jurisdictions. The company lost HK$11.55 billion last year compared with HK$12.49 billion in 2017.

To boost efficiency and make better use of capacity, Hutchison Port and Wharf’s Modern Terminals last month revealed a controversial plan to set up a powerful group known as the Hong Kong Seaport Alliance.

The alliance, which will take up 95 per cent market share at the Kwai Tsing port, is the subject of a high-priority investigation by the city’s competition watchdog to address concerns about cartel and antitrust behaviour.