Hong Kong sells third housing plot on disused airport runway at 12.7 per cent discount, in another sign of property market woes

- Kai Tak Area 4B Site 2 sold to a unit of China Overseas Land & Investment for HK$8.03 billion, or HK$13,523 per square foot

- The latest price tag is a 12.7 per cent discount to the previous plot sold in November, in another clear sign that Hong Kong’s property market has cooled

Hong Kong’s government, which relies on land sales for a substantial part of its revenue, has sold its final residential plot for the year at a 12.7 per cent discount to market valuation, in a further sign of the city’s cooling property market.

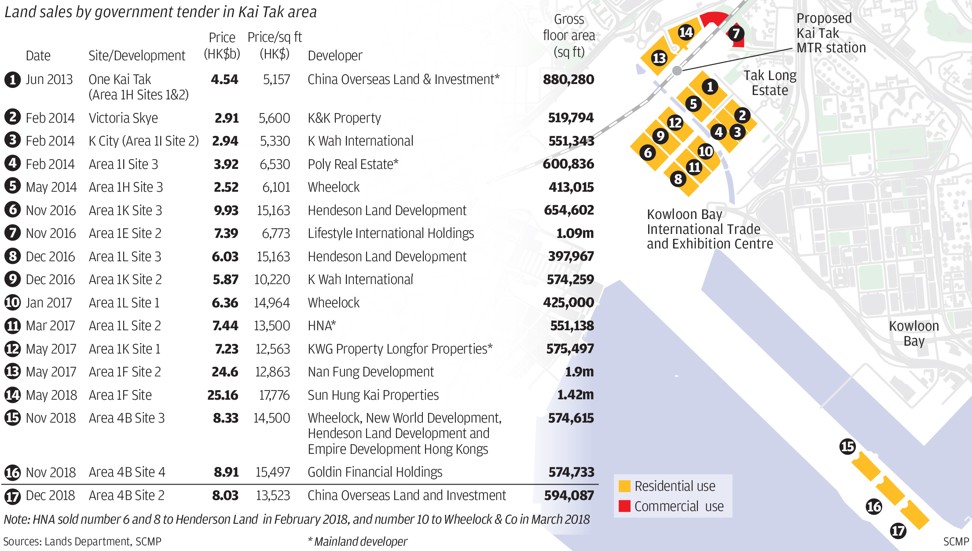

Kai Tak Area 4B Site 2, the third plot for sale on the former airport’s disused runway, sold for HK$8.03 billion (US$1.03 billion) to a unit of China Overseas Land & Investment, according to an announcement by the Lands Department. Six bids were submitted for the tender, which closed last Friday.

Market observers saw the low price as a sign developers are worried that Hong Kong’s stalling housing market will dip further in 2019.

“The price is a bit disappointing,” said James Cheung, executive director of Centaline Surveyors, who had previously valued the parcel of land at HK$15,500 per square foot. “Developers are not as aggressive as they were earlier in the year because the market has softened.”

Thomas Lam, an executive director at Knight Frank, said builders were worried they might have to offer their completed units at lower prices in the coming year.

“Also the potential for increasing interest rates in the city will push up their costs,” he added.

Lam expects the flats on the latest plot will be sold for HK$28,000 per square foot to cover the investment of China Overseas Land & Investment, the first developer to win a plot in Kai Tak, back in 2013.

Centa-City Leading Index, the home price index compiled by Centaline Property Agency, has fallen 6.4 per cent for 12 weeks for the week ended December 16, the longest losing streak since November 2008.

Still, 19 residential plots, including eight in Kai Tak area, remain unsold in the Hong Kong government’s land sale plan ended March 31, 2019.

Analysts will be looking at the Kai Tak Area 4C Site 3, which enjoys a full sea view, to test the market.

The plot, which could yield a gross floor area of 648,617 square feet, is up for sale and the tender will close on January 18, 2019.

“A plot like that is rare in the city because the future development there will be right in front of Victoria Harbour. Developers are expected to compete for the site, shrugging off the soured sentiment,” said Lam. “If fewer bids come in or a lower-than-expected price is seen, that would signal that they are losing confidence.”