Hong Kong’s Central district to see further 5 per cent gain in office rents this year, Nomura says

- Demand from co-working firms and limited space outside Central to push up office rents in 2019

The world’s most expensive place to rent office space may be about to get even costlier amid higher demand from co-working firms, according to Nomura.

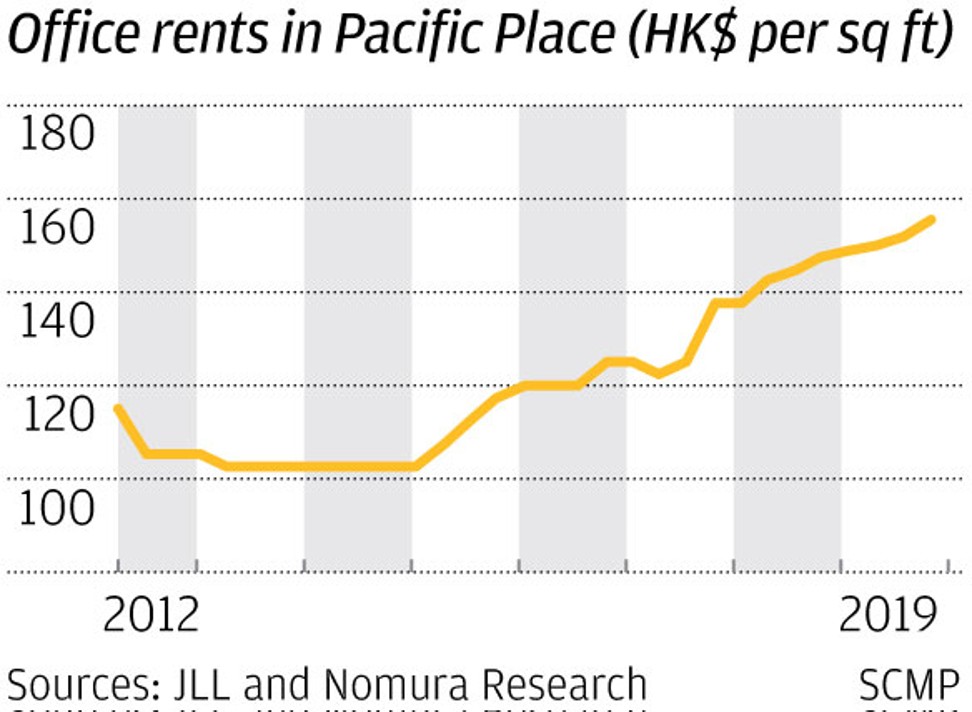

The cost of renting office space in Hong Kong’s main business district, Central, will rise by up to 5 per cent this year, according to an adjusted forecast by Nomura analyst Joyce Kwock on Monday.

The revised estimate marks a 180 degree turn from the bank’s prior estimate for a 5 per cent drop in office rental rates this year. Kwock cited higher demand from financial institutions, slowing decentralisation by law firms and limited space outside Central as additional factors for the revision.

“At present, there are more than 50 [co-working] operators at more than 80 locations in the city, covering more than 1 million square feet. Many new operators, especially those from mainland China, are still eager to establish a foothold in the city,” Kwock said in the report. “China funds’ expansion into Hong Kong and take-up of prime office space in Central was another major trend.”

The asking rent for prime office space in Central ranged from HK$97 (US$12.36) to HK$192 per square foot in November, according to figures from CBRE.

Kwock said a factor driving the market last year was uptake by mainland Chinese asset management firms eager to grow their investments outside China.

She said Hong Kong will not see a major wave of new office supply until 2021 to 2023, when space becomes available in Two Taikoo Place in Quarry Bay, the Murray Road project and as the Hutchison House redevelopment is completed.

Kwock said competition from grade A decentralised offices was a market concern in 2017 to 2018 amid completions of buildings such as Victoria Dockside, which enticed away a number of tenants from Central.

“Nevertheless, by end 2018 these three competitor building spaces were largely filled up, with 80 to 100 per cent occupancy rates,” Kwock said. “The remaining available spaces in these buildings are rather limited to offer attractive rents or space to sizeable Central office tenants.”

However, Nomura’s optimism contrasted with other property experts that see the multi-year growth in Central rents as drawing to a close this year.

“The big element of demand growth in recent years is from Chinese financial institutions … that demand is slowing down,” said Peter Churchouse, a veteran property investor with more than 30 years of experience. “So rental growth is likely to slow, or even maybe turn mildly negative. And we do have a bit of supply coming on, but it’s not in Central.”

Churchouse expects a single-digit decline in prime rents in Central in the next 12 months.

Colliers said office rents in Central and Admiralty could drop by 3.8 per cent as more office supply becomes available and as mainland companies vacate space.