China semiconductor imports decline slightly in April, but global chip sales continue to boom

- China’s semiconductor imports were down 7 per cent in April from the previous month, but up 23 per cent year over year despite global shortages

- The global semiconductor market continues to see strong growth, but shortages are expected to persist throughout the year

China imported 54.7 billion semiconductor units in April, worth US$33.1 billion, according to data released by the General Administration of Customs on Friday. It was a 7 per cent fall from the previous month, when the country imported 58.9 billion semiconductor units worth US$35.9 billion. However, imports for the month were up 23 per cent year on year, from 44.4 billion units worth US$27 billion.

China’s semiconductor imports are also up 30.8 per cent so far this year compared with the same period last year, with shipments reaching 210 billion units, worth US$126 billion, in the first four months.

Why semiconductors are important in the US-China tech war

“Overall, the semiconductor industry remains on track to deliver another strong year of growth as the super cycle that began at the end of 2019 strengthens this year,” said Mario Morales, programme vice-president for semiconductors at IDC. “The markets remain narrowly focused on shortages across specific sectors of the supply chain, but what is more important to emphasise is how critical semiconductors are to every major system category and … that remains unabated.”

02:15

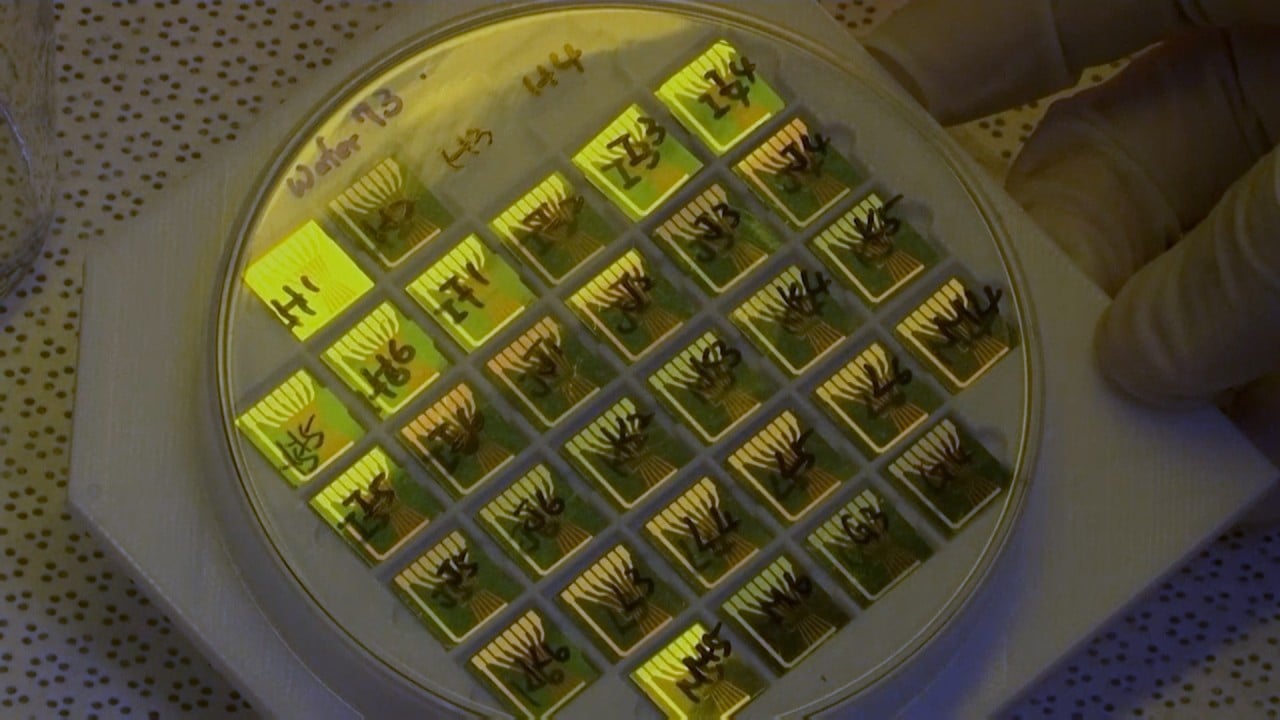

Taiwan researchers make Covid-19 self-test machine using biosensor chips for results in minutes

However, supply constraints are expected to continue throughout the year.

The industry’s first hint of trouble came in spring of last year, when it became clear Covid-19 was turning into a pandemic. Existing chip inventories kept new electronics flowing, but eventually semiconductor shortages started to hit the carmakers, which had cancelled orders in anticipation of a slowdown in demand. The impact is now being felt across the board.

“Much like a traffic jam and the ripple effect, a disruption in the semiconductor supply chain operating close to capacity will impact across the supply chain,” IDC said. “The industry will continue to struggle to rebalance across different industry segments, while investment in capacity now will improve the industry’s resiliency in a few years.”

Everything you need to know about the US-China tech war

The country plans to use more chips designed and produced by domestic semiconductor companies by 2025 to mitigate supply chain risks from geopolitical tensions.