Topic

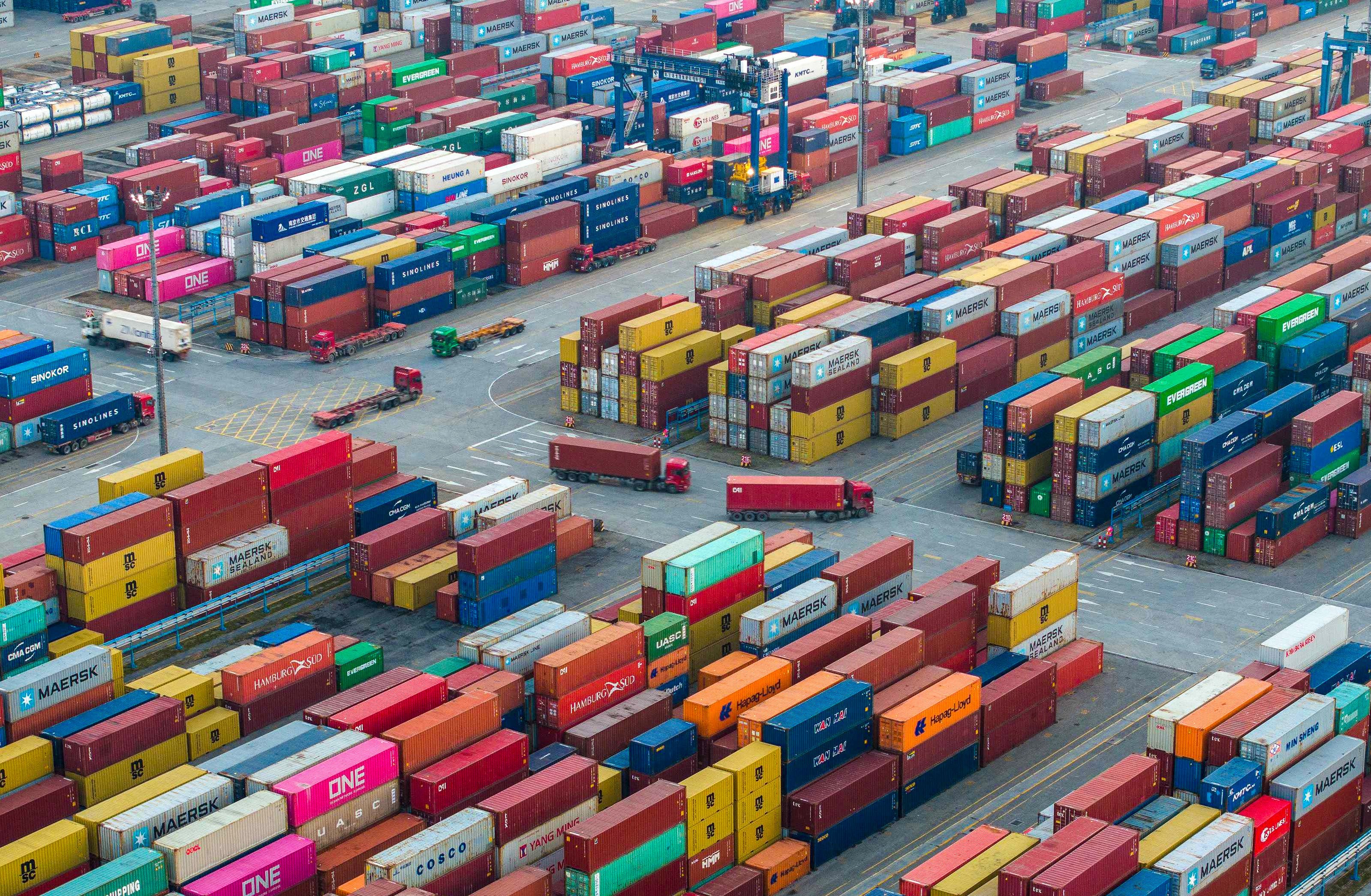

Commodity market action from around the world with a focus on the commodities that matter most to investors in Hong Kong and China.

- The concerns come as a US delegation in Kuala Lumpur holds talks with officials over Tehran’s alleged underhanded selling of oil through service providers

- ‘Dark fleet’ of tankers believed to be operating under the guise of various brands, with secret oil transfers taking place off the Malaysian coast

Younger consumers have flocked to buy bite-sized gold bars from retail stores and vending machines amid frenzy for the precious metal.

The play on China’s panda diplomacy has been proposed amid new regulations meant to ensure palm oil products don’t contribute to deforestation

The hike highlights Saudi Arabia’s efforts to keep the market tight amid fading war risk in the Middle East, which has helped drive oil prices in London lower.

Team led by a group of Chinese researchers cloned a specific gene that is resistant to Asian soybean rust amid Beijing’s focus on food security and tech self-reliance.

Chinese farmers are keeping the fewest pigs for breeding since 2020, raising hopes of sustained profitability after years of losses. But the turnaround may not speak to the broader economy, analysts say.

Chinese-produced durian is set to be available to the public in July, with production from the tropical island of Hainan likely to reach 200 tonnes this year, although Thailand and Vietnam are set to remain the largest sources.

Wars in the Middle East and Ukraine, and continuing lower US interest rates have burnished gold’s billing as an investment, but it is the unrelenting Chinese demand that is juicing the rally.

Energy market sanctions imposed on Moscow have already had a dramatic impact on China’s buying habits, helping Russia surpass Saudi Arabia to become the largest oil supplier to Beijing last year.

Yield-hungry Chinese investors are flocking to pockets of strength as property woes, volatile stocks and falling deposit rates reduce their options.

The move had been widely expected this month, and a formal announcement from Chinese commerce authorities shows how much ties with Canberra have improved in the past year.

‘Moment to celebrate’ hailed as boon for South American country’s producers who have faced weaker demand after sanctions on Russia over Ukraine war.

China’s imports of Australian coal increased by 3,188 per cent year on year to US$1.34 billion in the first two months of 2024 amid improving relations between Beijing and Canberra.

More than 99 per cent of Vietnam’s durian exports went to China last year, and the Southeast Asian country is expected to ship US$3.5 billion of the fruit in 2024.

Earnings at the world’s fourth-largest iron ore miner is forecast to fall by 14 per cent over the next year, the worst pullback compared with peers BHP, Rio Tinto and Vale, according to analyst estimates.

More than 80 canals have dried up in the Tran Van Thoi district of Ca Mau province, where agricultural production is entirely reliant on rainwater.

The barter deal allows sanctions-hit Iran to avoid having to use up scarce hard currency to pay for imports of popular tea. It also allowed Sri Lanka to pay with tea, as the country was short of foreign currency.

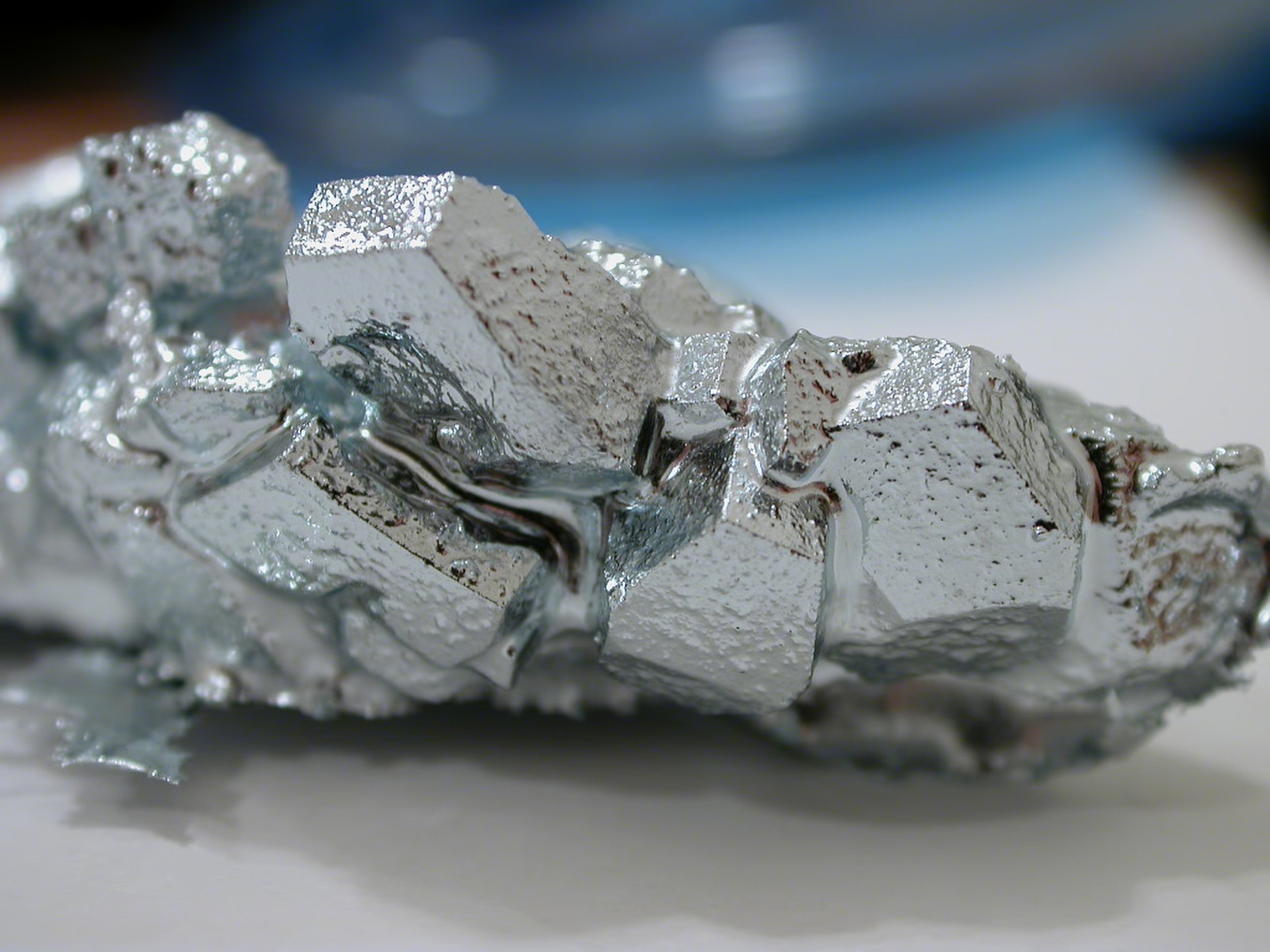

Canberra has placed nickel in its critical minerals list, which allows industry players access to billions of dollars.

The guochao or ‘China chic’ trend, which celebrates Chinese identity, coupled with gold’s increasing value, is creating a market opportunity.

Beijing’s decision to resume global shipments after months-long halt triggered a leap in sales of the mineral key to manufacturing semiconductors.

China’s other sectors like electric vehicles and demand from India are likely to offset some impact, but exporters will have to seek newer markets, analysts say.

Gold’s rising role as a safe-haven investment in China has made it the world’s top buyer while traditional assets such as real estate and stocks are seen as more risky.

Africa’s trade deficit expanded to US$64 billion as China recorded a drop in trade with top partners on continent – South Africa, Angola, Nigeria, the DRC and Egypt – which are predominantly resource-rich nations.