Topic

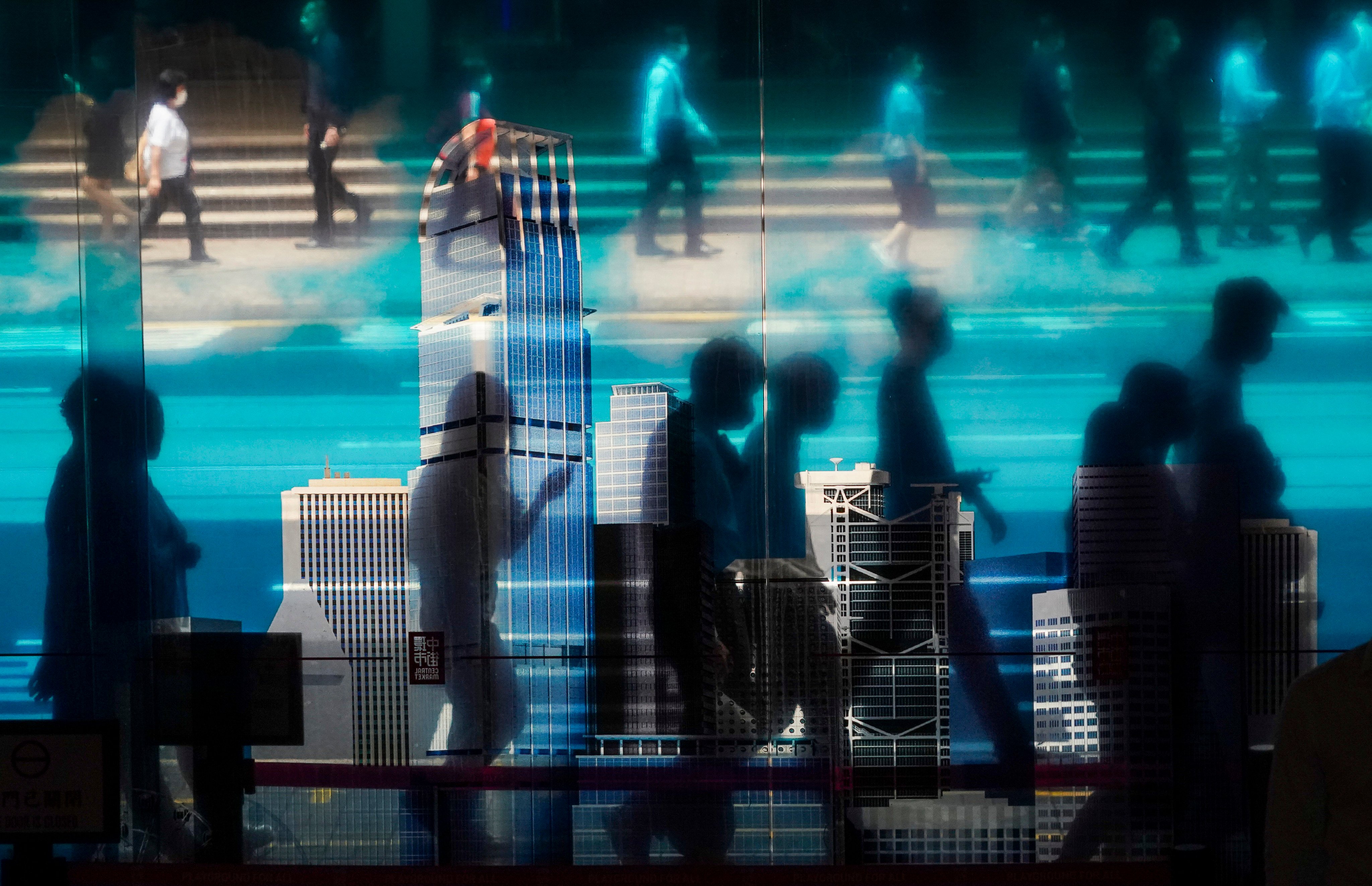

The Hong Kong Monetary Authority (HKMA) was established in April 1993 by merging the Office of the Exchange Fund with the Office of the Commissioner of Banking. The HKMA is responsible for maintaining monetary and banking stability, including maintaining currency stability within the framework of the Linked Exchange Rate system under which the Hong Kong dollar is pegged to the US dollar.

The real estate market is recovering slowly, but a big rebound is a distant hope with the Hong Kong Monetary Authority warning rates may stay high.

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

Large supply of homes due to come online soon in Hong Kong will, hopefully, help thwart the rise of a new generation of speculators.

With the Fed expected to start cutting rates before the end of the year, margins for lenders will narrow, potentially exposing threats in other areas. Hong Kong’s banks have made provisions and shored up balance sheets to ward off China property risk

From wealth management to bonds and banking services, mainland China has shown further support for city as a financial hub

Meeting of leading central bankers an answer to those who doubt city’s reputation as global financial centre.

Strong bond market drives rebound by war chest that helps defend Hong Kong dollar and hopes are high it will continue.

- A fictitious article made to look like a South China Morning Post news story has circulated on social media, promoting an online trading tool

- Sham article is almost identical to one debunked two weeks ago, featuring Hong Kong movie star Donnie Yen and US talk show host Jimmy Kimmel

Enhancements aim to further open up China’s financial markets and strengthen Hong Kong’s status as an international financial centre.

Hong Kong will roll out the red carpet to hundreds of top global bankers and finance executives in November for a high-level financial conference to be hosted by the Hong Kong Monetary Authority.

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, continued its comeback in the first quarter, posting a return of HK$54.3 billion (US$7 billion) as rising overseas stock markets offset losses in domestic equities.

The HKMA plans to replace the term ‘virtual bank’ with ‘licensed digital bank’ in reference to the city’s eight branchless lenders to remove negative connotations associated with the term in Chinese.

Sales of the units, which ranged from 340 sq ft to 783 sq ft at HK$18,597 to HK$28,350 per square foot, were suspended after a red rain signal on Saturday.

The HKMA has issued a ‘green taxonomy’ framework to help banks and investors determine the sustainability of economic activities, the latest effort to boost the city’s standing as a green finance centre.

Hong Kong will implement sound cybersecurity measures reinforced by strong backup systems to ensure a smooth launch of the MPF electronic platform next month, according to the MPFA’s Ayesha Lau.

Hong Kong’s biggest lenders including HSBC, Standard Chartered and BOCHK will keep their key lending and deposit rates unchanged, meaning local businesses and mortgage borrowers will have a longer wait for the cost of borrowing to decline.

HKMA reiterated its warning for Hong Kong’s borrowers to “carefully assess” their financial power in considering buying property or taking on mortgages, as high interest rates “may last some time.”

Hong Kong’s largest virtual bank is preparing to introduce virtual asset trading services for retail investors, CEO Ronald Iu says. Plans are afoot as a new regulatory regime is rolled out in June.

Hong Kong kept its key interest rate unchanged for a sixth consecutive time in lockstep with the Federal Reserve’s overnight decision, with sticky US inflation forcing investors to delay rate cut bets.

Scammers have published a fictitious article with the appearance of a South China Morning Post story and a reporter’s byline to promote two online financial trading apps.

The number of Hongkongers with negative-equity loans stood at 32,073 in the first quarter of the year, tripling from the previous quarter and the most since some 40,000 cases were recorded in the first quarter of 2004.

Buoyed by the brisk sales of flats following the removal of Hong Kong’s property cooling measures, the city’s developers have this year launched 4,800 new units as of last week, a seven-year high.

Commissioner of Police Raymond Siu says deception cases in city grew 0.9 per cent, with all but investment scams declining between January to March.

Hong Kong offers plenty of wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, according to speakers at the Apec Business Advisory Council summit.

Hong Kong’s SMEs are more optimistic than their peers in mainland China, Singapore and Australia when it comes to growing their businesses this year, thanks to government support and an increase in online sales, a survey shows.

The Hong Kong Monetary Authority’s SME information platform is part of its ongoing efforts to help SMEs affected by the shift in consumer and tourist spending patterns.

A new operating model enabling Hongkongers to use the services of multiple credit reference agencies for the first time will start on April 26, the Hong Kong Association of Banks and two other industry groups announced.

Property agents have raised sales forecasts for the year amid project launches at discounted prices, but say a lack of a rate cut could pare those estimates.

Scam operators seemingly thumb their noses at the regulator, which recently launched a campaign warning the public about financial frauds.

Tokenisation has proved to be cheaper, more efficient and better than ‘the old-fashioned way of trading’, Noel Quinn says, but HSBC will stay ‘away from crypto’.

Police say 505,000 scam alerts sent to users of Faster Payment System (FPS) between launch of warning system in November and March.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

Hong Kong property sales rose to a 10-month high in March, surpassing 5,000 deals a month after the government lifted all property cooling measures, data from the government shows.

Monetary authority announces a nine-point plan that offers reassurance about access to credit relief amid market rumours of loans being called early.

HSBC Gold Token, which will be available on the lender’s online banking and mobile app, is the first such retail product to be issued by a bank, according to HSBC, as the government pushes for more digital assets to be rolled out for public use.

New home sales in Hong Kong stuttered slightly on Friday, with buyers giving a lukewarm response to Henderson Land Development’s latest project in Tai Kok Tsui.