Topic

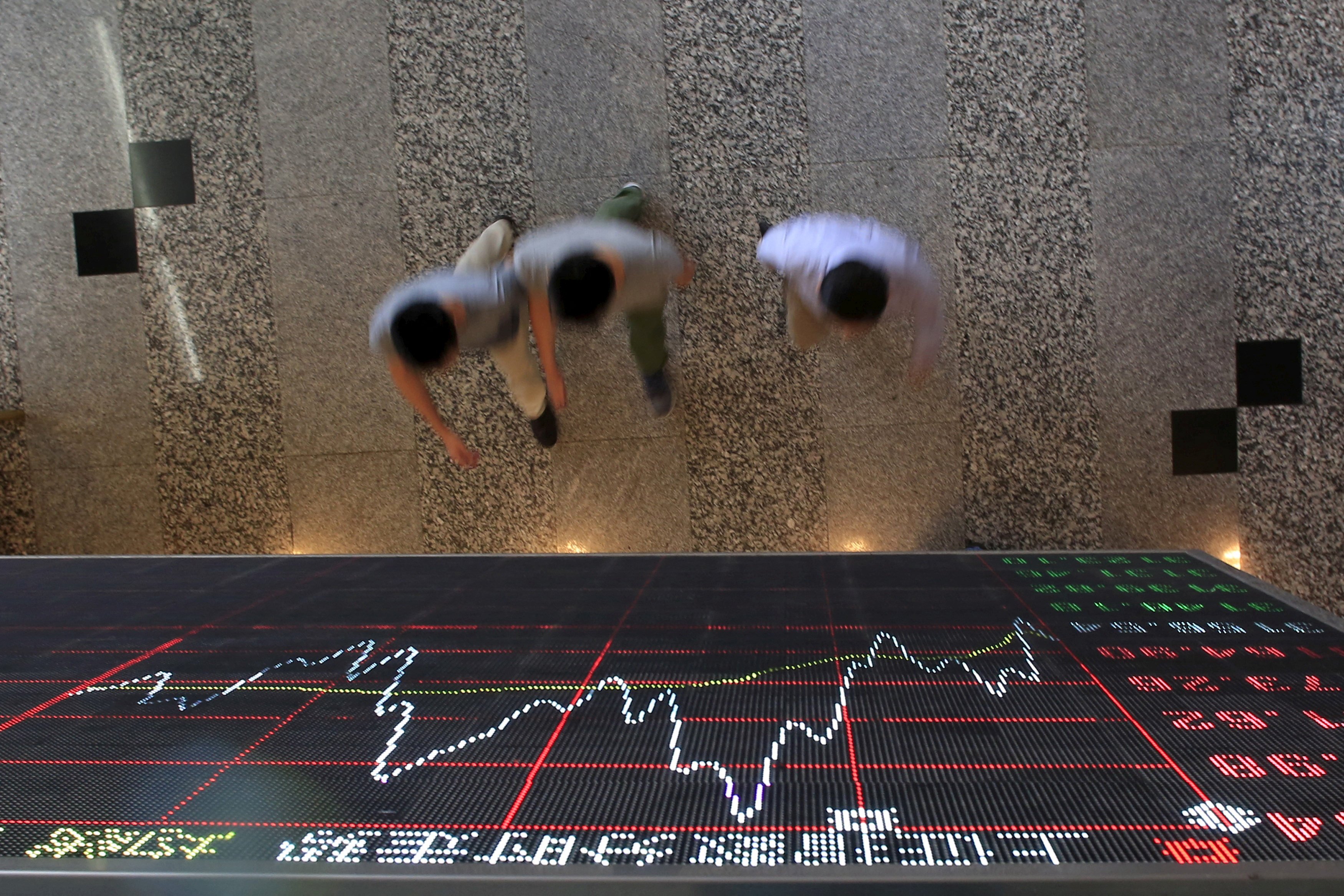

A-share focus is for readers wanting to know more about mainland Chinese investment markets, and especially the A-share market in Shanghai, which has become accessible to international investors since the launch of the Shanghai-Hong Kong stock connect scheme in late 2014.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

- Valuations in China’s markets are ‘worthy of allocations’, Everbright Securities analyst says

- Overseas buying is expected to carry on at least in the near future: Goldman Sachs

Hong Kong’s market is the best performer among major peers globally this month, and better-than-expected manufacturing activity in mainland China is expected to add further impetus.

Hong Kong stocks closed near bull market territory after corporate earnings continued to surprise on the upside with property sector support measures on mainland China adding to the momentum.

CICC cuts pay amid brutal business environment as a sluggish economy and dismal IPO volumes hurt the financial services sector.

Guolian Securities plans to buy a 95.48 per cent stake in unlisted Minsheng Securities, in an acquisition that is expected to make it a top-20 brokerage.

Hong Kong stocks rose and completed its best weekly performance since October 2011 as positive earnings from top-tier Chinese companies and supportive policy measures boosted investor confidence

Global investors turn constructive on Chinese stocks after a series of stock market reforms aimed at strengthening scrutiny and boosting returns to shareholders.

Hong Kong stocks rise on optimism that the appetite for Chinese assets is returning as Beijing pledges support to markets and signs of an earnings recovery emerges.

Hong Kong stocks rose for a third day after earnings optimism drove the benchmark Hang Seng Index to a five-month high.

Goldman says Chinese stocks may rise 40 per cent amid ‘more conducive trading environment’ in near term, while UBS raises ratings on Chinese and Hong Kong stocks to overweight.

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base

CSRC’s new chief Wu Qing has sought to improve corporate governance and close deep valuation discounts in a bid to revive investors’ faith in China’s US$9 trillion stock market and these bold moves have met with some early success.

Asia looks ready to turn a corner in quarterly earnings growth this results season. Here are five key themes to watch as the report cards roll in over the next few weeks.

Hang Seng Index hovers near a five-week low after comments by Fed chairman Jerome Powell, who said it could take ‘longer than expected’ to get inflation back on target.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

Hong Kong stocks ended steady but the mood was cautious as ahead of economic data releases that will drive sentiment later in the week.

The Chinese stock market is poised to see the emergence of shareholder resolutions on ESG issues next year, as incoming corporate governance reforms start allowing many more minority owners to present proposals for voting, a stewardship expert says.

China’s state-directed buying binge has swollen the size of exchange-traded funds (ETFs) tracking the underlying benchmark CSI 300 Index, helping them outperform the market while boosting their asset-size ranking.

Global fund managers have become more positive about Chinese stocks after the securities regulator took a flurry of forceful measures to halt a three-year decline, according to a joint-venture brokerage of HSBC Holdings.

Bond funds, driven by rate cut hopes, outperformed their stock market peers, which helped them gain a dominant share of issuance in the first quarter

Investors should exercise more caution when it comes to the valuations of Chinese stocks, as corporate earnings growth is set to slow because of Beijing’s pursuit of high-quality economic growth, according to China’s biggest money manager.

Chinese state intervention has tentatively put a floor under stocks, but corporate earnings show little sign of providing upwards momentum as pressure is building for investors to pocket profits from the decent gains the market has made.

Global fund managers have increased their exposure to Chinese yuan-traded stocks for a second month in March, indicating that foreign appetite for these shares is recovering.

‘The slowdown in IPOs will carry on, and the listing process for mega IPOs is expected to be lengthened,’ an analyst says, as the market watchdog has pledged to improve listing quality.

Swiss agrichemicals and seeds giant Syngenta Group has withdrawn its application for a listing in Shanghai amid China’s slowing equities market.