Topic

The Chinese yuan, also known as the renminbi, is already convertible under the current account - the broadest measure of trade in goods and services. However, the capital account, which covers portfolio investment and borrowing, is still closely managed by Beijing because of worries about abrupt capital flows.

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

Close ties with mainland China have led to the latest unflattering report card from the ratings agency, but city can prove it wrong.

Recent deal between China and Saudi Arabia is an important step as world wakes up to the consequences of denominating almost all global trade in the American currency.

- Police in China’s northeastern Jilin province made the arrests in connection with a scheme that sent US$296 million to South Korea

- Beijing has increased its efforts in combating illicit crypto outflows, including an update to its Anti-Money-Laundering Law now under review

Finance deals made through smaller Chinese banks would help ‘resolve the threat of secondary sanctions’, according to fresh findings by a Renmin University institute.

The incentives will inject a dose of optimism and confidence in the capital markets, enhance cross-border trading schemes and boost the yuan, tax experts say.

Solo travellers from eight more mainland Chinese cities will be allowed to visit Hong Kong from May 27.

With China’s ties to Russia under stronger scrutiny from the West, banks are keeping a closer eye on transactions with links to Moscow – and China’s exporters are concerned their bottom line will suffer.

Analysts say China’s central bank, with an eye on the yuan’s stability, could let it weaken gradually, but such a move ‘could backfire to some degree’.

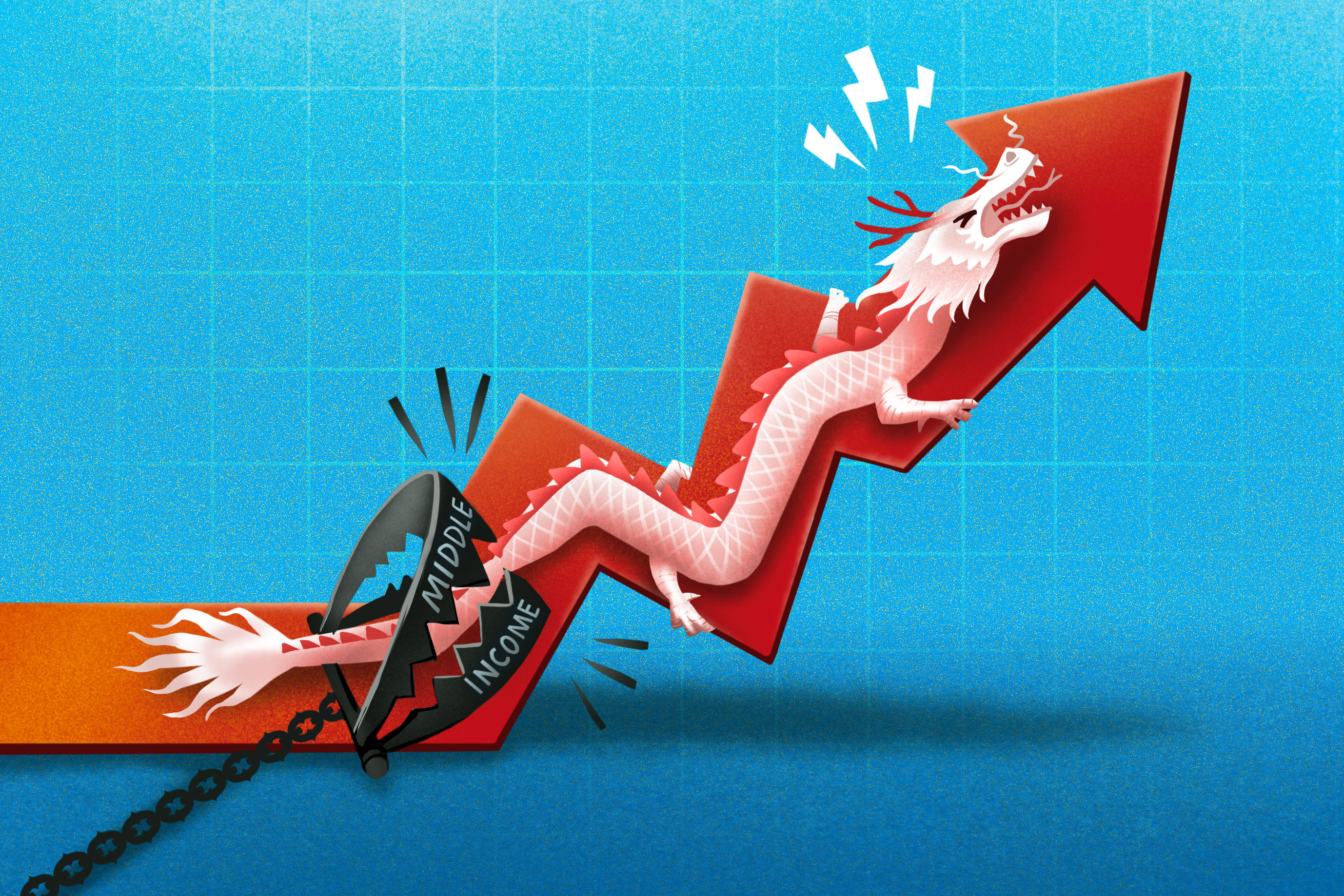

Predictions China would have already joined the group of high-income nations have yet to bear fruit. Is it still possible to break through the middle-income ceiling – and is it still an important benchmark?

A highly placed scholar is encouraging China to offload more of its holdings in Treasuries as overseas assets become a riskier proposition thanks to erratic geopolitical shifts.

Predictions restaurant trade will suffer from golden week double whammy despite an estimated 800,000 tourist arrivals from across the border.

China’s yuan has lost more value against the US dollar as interest rate cuts have yet to materialise, leading exporters to find whatever alternative assets they can until exchange differentials subside.

China’s managed currency is seen as an anchor for its regional peers, meaning small moves can have an outsize impact.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

In an uncertain monetary environment where the US Federal Reserve has yet to announce interest rate cuts, China’s central bank is seeing potential moves to increase activity constrained by pressures on the yuan.

Even after President Xi Jinping has asked for China’s central bank to trade government bonds, the outcome is likely to remain limited as the bank does not want to trigger negative outcomes for inflation and exchange rates.

Beijing’s new off-budget treasury bonds will span decades, and they have been sold only 3 times before – in some of the most challenging economic times.

People’s Bank of China (PBOC) has named two new academic advisers for its monetary policy committee, which submits advice to the State Council on key moves including interest rate changes and the value of the yuan.

AIA Group’s new sales in Hong Kong and mainland China continued to grow in the first two months of the year, indicating strong momentum from last year is carrying over in its two major markets, according to its top boss.

Two years after the invasion of Ukraine isolated Russia from the Western financial system, major energy and mining companies have come to rely on the yuan for most of their foreign-currency needs

High-profile economist and former State Council researcher warns that potential US capital injections in China, following any Fed rate cuts, might be tumultuous for already-battered markets.

Analysts say that while enhanced financial ties between the two countries could help internationalise China’s currency, Beijing tends to play it safe when upholding its neutrality regarding the war in Ukraine.

HSBC, Standard Chartered and Hang Seng Bank are rolling out more products tied to the Wealth Management Connect scheme amid a drive by Beijing to boost the Greater Bay Area’s financial markets.

China’s next big impending change in the financial market is letting more foreign institutional investors into its onshore repo market.

China’s latest act is to invite more foreign players to its US$232 trillion onshore repo market. As a precursor, Hong Kong will treat Chinese government bonds and policy bank bonds as eligible collateral in its yuan liquidity facility.

Hong Kong is set to continue capitalising on offshore yuan funding opportunities after ‘dim sum’ bonds and loans – offshore debt denominated in the yuan – grew exponentially in 2023, regulators say.

Policy sales have been boosted by the reopening of the mainland border, a weakening yuan and the interest rate gap between China and the United States, the Insurance Authority says.

Hong Kong Financial Secretary Paul Chan says stronger links between city’s financial sector and rest of Greater Bay Area being forged.

People’s Bank of China (PBOC) is set to leave the rate on its one-year policy loans – the medium-term lending facility (MLF) – steady at 2.5 per cent on the first working day after the Lunar New Year holiday ends.