Investors pile into Viva Biotech’s Hong Kong IPO as they are confident of the R&D services provider’s business model

- Not only is the firm profit-making, but its investment in potential drug candidates has made it attractive to investors, says Louis Tse Ming Kwong of VC Asset Management

- Viva’s business model of taking equity in smaller companies is a convenient way of having many shots on a goal in the Asian biotech, says Brad Loncar of Loncar Investments

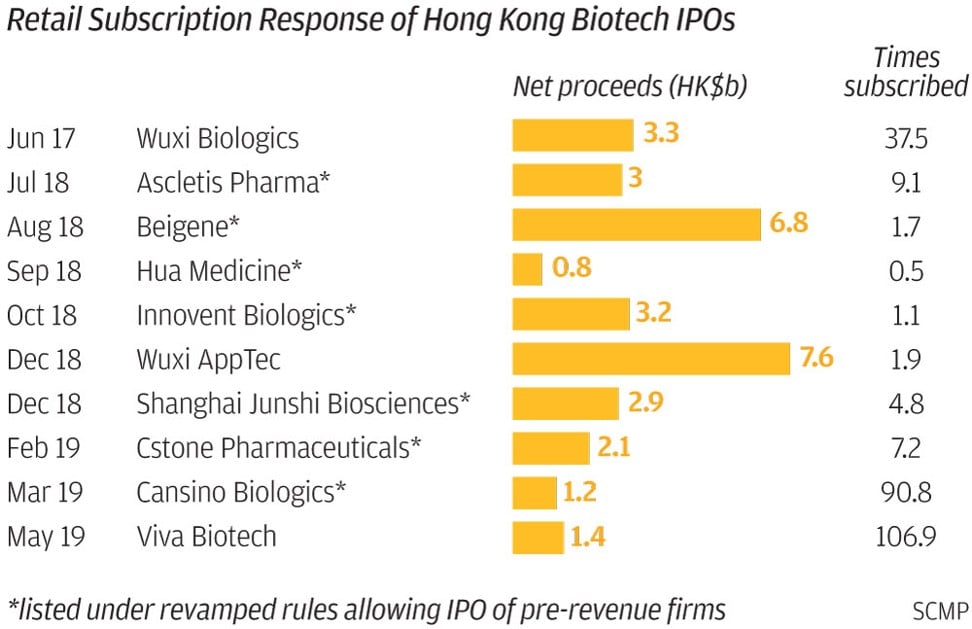

Viva Biotech’s hugely popular IPO last week, which was oversubscribed was 106.9 times, reflects growing risk appetite among retail investors in the nascent drug research services sector in Hong Kong, according to analysts.

The retail tranche of the Shanghai-based company’s HK$1.37 billion (US$176 million) IPO handily beat the 90.8 times subscription interest seen in vaccines developer Cansino Biologics’ offering in March. Subscriptions to Viva’s IPO topped its eight predecessors – mostly unprofitable drug developers – in the past two years, which ranged between 0.5 to 9.1 times.

Louis Tse Ming Kwong, managing director of VC Asset Management, said the massive response to Viva was helped by its relatively small offering size, as was Cansino’s IPO.

“It is a supply and demand game,” he said. “Investors were attracted to Viva because of its more defensive business model. Not only is it already profitable because of its drug research services, but it also has potential investment gains from its growing investment portfolio in the sector.”

Viva priced its shares at the high end of the indicative range, defying an earlier prediction. It also closed on Friday at HK$5.03, 14 per cent above its IPO price of HK$4.41.

“We cautioned that while the market backdrop is favourable, Viva’s fundamentals are mixed. [With] Viva’s valuation highly dependent on fair value gains from its portfolio companies, we believe Viva can just about justify the low-end of IPO price range,” wrote Smartkarma IPO analyst Arun George late last month.

Viva, a 11-year-old R&D services provider to pharmaceuticals companies, made 210 million yuan (US$30.7 million) in revenue and 105.9 million yuan in pre-tax profit last year.

Some 47.6 million yuan of that profit came from net paper gains on the value of its investment portfolio and 30.9 million yuan from “other gains” – primarily investment assets disposals.

The company is the fourth largest in China’s oligopolistic drug discovery services industry, with a 2.6 per cent share, far trailing the largest two players controlling 53.3 per cent and 29.6 per cent of the market respectively, according to market research firm Frost & Sullivan, which was hired by Viva to research the market for its IPO prospectus.

“We noticed a few years ago many people were getting into the cash-for-service business, resulting in falling gross profit margins as competition intensified,” said Cheney Mao Chen, Viva’s founder and chairman. “To counter this, we were thinking of ways to participate in our customers’ projects and enjoy the potential upsides from the intellectual properties they generate.”

In 2015, Viva started investing in its customers’ ventures by accepting stakes in them instead of payments for its services.

Viva has some 31 new drug development projects under its “incubation” support, with an average investment of US$1.5 million each.

It aims to add 21 projects this year, 35 next year and 50 the year after, bringing the total to 137 projects by the end of 2021. It typically takes between 10 and 30 per cent stake in each project.

It has two “incubation” centres in Shanghai and Jiaxing, Zhejiang province. It plans to add three more in Shanghai, Jiaxing and Chengdu.

Viva aims to exit half of its stake in each investment within 30 months, and the remainder in the following 36 months, by which time the average drug candidate could be ready to enter phase two clinical trial.

It exited one investment last year thanks to a buyout, and sold down its stakes in three others.

“Some investors view Viva Biotech’s business model of taking equity in smaller companies as a convenient way of having many shots on goal in the biotech boom that is happening in Asia,” said Brad Loncar, chief executive of Kansas-based investment firm Loncar Investments and compiler of the Loncar China BioPharma Index.

But investing in early-stage start-ups entails much higher risks as typically only one out of 10 drug candidates, which make it to phase one clinical trial, go on to become a commercial success.

Most of the 31 firms in which Viva has invested in have yet to see their drug candidates enter phase one trial.